DeepMind Unleashes Regulatory-Dodging Shopping Spree to Supercharge Gemini AI.

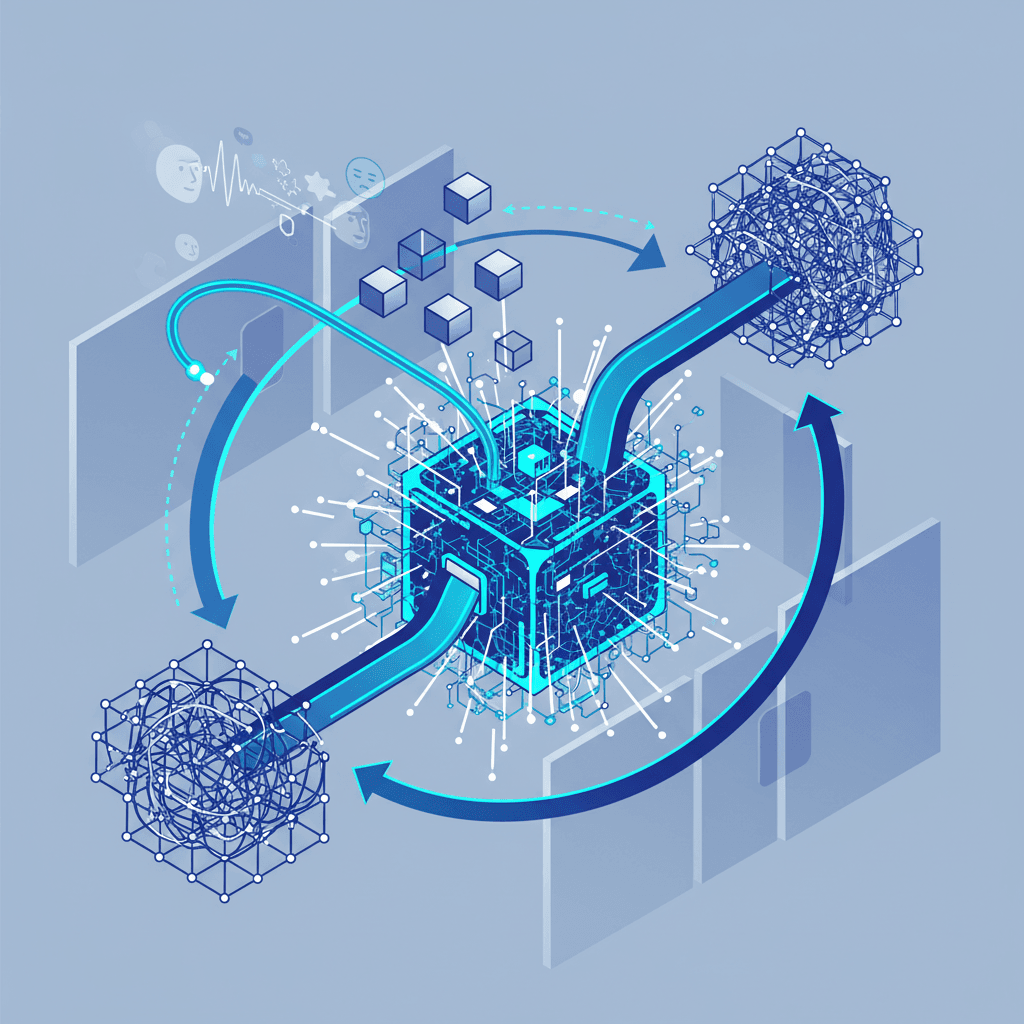

DeepMind’s hybrid strategy integrates emotional AI and 3D modeling expertise to rapidly accelerate the Gemini model.

January 24, 2026

Google DeepMind has executed an aggressive and strategic AI shopping spree, closing three distinct deals in a single week that collectively illustrate a sophisticated playbook for expanding market dominance while artfully navigating the increasingly complex regulatory landscape. This flurry of activity, involving an outright acquisition, a key talent and technology licensing agreement, and a significant strategic investment, serves to rapidly integrate critical, nascent AI capabilities into Google’s core research and product teams, particularly bolstering the capabilities of the Gemini model. By prioritizing the acquisition of elite talent and specific intellectual property over conventional large-scale corporate mergers, Google is accelerating its competitive position against rivals like OpenAI, Microsoft, and Meta.

The core of this strategy revolves around a calculated approach to talent acquisition, effectively co-opting smaller, innovative startups through structures that fall outside the traditional bounds of antitrust scrutiny for major tech acquisitions. The most emblematic of this new hybrid model is the agreement with Hume AI, a startup specializing in models that recognize and interpret emotions in voice. DeepMind did not fully acquire the company, but instead secured a non-exclusive licensing deal for Hume AI’s technology, while simultaneously bringing the startup’s CEO, Alan Cowen, a psychologist by training, and approximately seven key engineers, directly onto the DeepMind team[1][2]. This transaction effectively performs a high-value acqui-hire for essential emotional AI expertise, a capability widely anticipated to be critical for the next generation of voice interfaces and customer-facing AI products[3]. The move echoes a recent, high-profile transaction by Microsoft, which acquired the founders and dozens of staff from the AI startup Inflection, paying a substantial licensing fee to circumvent a full acquisition. Hume AI, which remains an independent entity projecting considerable future revenue, now effectively acts as a long-term technology and talent pipeline for Google without the regulatory headache of a conventional merger[3][1].

In a more traditional, yet equally targeted move, DeepMind completed the acquisition of Common Sense Machines (CSM), a small, Massachusetts-based startup of roughly a dozen employees[4]. The startup’s core technology centers on converting two-dimensional images into three-dimensional objects using AI models, a vital capability for advancing generative AI beyond text and standard imagery and into spatial computing, robotics, and immersive environments[4]. The deal, for which the price was undisclosed but involved a company previously valued at $15 million, is a classic example of an acqui-hire designed to pull a specialized team and its proven technology directly into the parent company’s research arm[4]. This acquisition is further characterized by the "return of alumni" theme, as CSM’s co-founder, Tejas Kulkarni, had a prior working history within Google DeepMind[4]. Such acquisitions are not merely about the technology, but about absorbing the culture, methodologies, and specific domain knowledge that only a small, focused startup can develop in a rapidly emerging field.

Completing the trio of deals is a strategic investment in Sakana AI, a Tokyo-based startup whose valuation has rapidly soared to become one of Japan's highest-valued AI firms[4]. Sakana AI’s leadership is notable for its deep connections to Google’s past triumphs, as its co-founder, Llion Jones, was a co-author of the seminal Transformer architecture research paper that underpins modern large language models[4]. This deal represents the "strategic partnership with former employees" component of the playbook. Sakana AI is focused on researching alternatives and improvements to the current Transformer architecture, a frontier identified by other leading AI researchers as an important new direction[4]. The partnership outlines plans to integrate Google’s existing AI models with Sakana’s proprietary technologies to drive AI-powered scientific discoveries and build high-security solutions for government and financial institutions, providing Google a significant strategic foothold and competitive advantage in the burgeoning Japanese and Asian AI markets[4].

The combined effect of these three deals—the acqui-hire of a 3D generation team, the hybrid acquisition of emotional AI talent and licensing of its technology, and the strategic investment in foundational research led by alumni—signals an intense focus on diversifying DeepMind’s foundational capabilities. This pattern of selective integration, where key talent and IP are secured without triggering a full merger process, is a definitive trend in the current AI arms race[3]. It highlights a recognition among the largest tech companies that the greatest constraint to AI progress is not necessarily capital or computing power, but a small pool of world-class, specialized research and engineering talent. By leveraging licensing deals and strategic investments, DeepMind can swiftly integrate cutting-edge expertise in areas like multi-modal AI (3D object generation), emotional intelligence, and next-generation model architectures, all while keeping the total volume of reportable M&A activity low. The emerging narrative is one of a new M&A style, where "acqui-licensing" and "alumni investment" are replacing the traditional corporate buyout as the primary mechanisms for market consolidation and technological advancement in the AI sector[3]. This strategic maneuver ensures that DeepMind’s product suite, especially its flagship Gemini model, is rapidly infused with specialized capabilities, thereby maintaining a fiercely competitive pace in the global race for artificial general intelligence.