Unity Bank halves API time-to-market with IBM, fuels digital agility.

Unity Bank's IBM-powered API hub cuts innovation time by 50%, driving agility for customer-centric services and open banking.

September 26, 2025

In a strategic move to accelerate its digital transformation, Unity Small Finance Bank has leveraged IBM's integration solutions to drastically enhance its operational agility. The collaboration has enabled the new-age bank to cut the time required to bring new Application Programming Interfaces (APIs) to market by a remarkable 50 percent. This significant reduction in development and deployment cycles is the direct result of establishing a centralized API hub, a foundational shift that empowers the bank to innovate faster and respond more dynamically to customer needs in the competitive financial landscape. The partnership underscores a broader trend within the banking industry, where the ability to securely and efficiently manage APIs has become a critical determinant of success, directly impacting how quickly new products and services can be offered to consumers and business partners.

The modern financial services sector is characterized by intense pressure to innovate, driven by evolving customer expectations and the rise of agile fintech competitors. For institutions like Unity Bank, this necessitates a robust and flexible technological backbone capable of supporting rapid development and integration. A key challenge in this environment is managing a growing and complex ecosystem of applications and data sources spread across hybrid cloud infrastructures, which often include both on-premise systems and public cloud services like AWS.[1] Without a unified approach, managing the security, governance, and lifecycle of APIs can become a significant bottleneck, slowing down innovation and increasing operational complexity. This fragmentation can prevent seamless data flow between core banking systems and new digital channels, hindering the development of integrated customer journeys and making it difficult to collaborate effectively with external partners, a crucial component of the modern open banking paradigm.

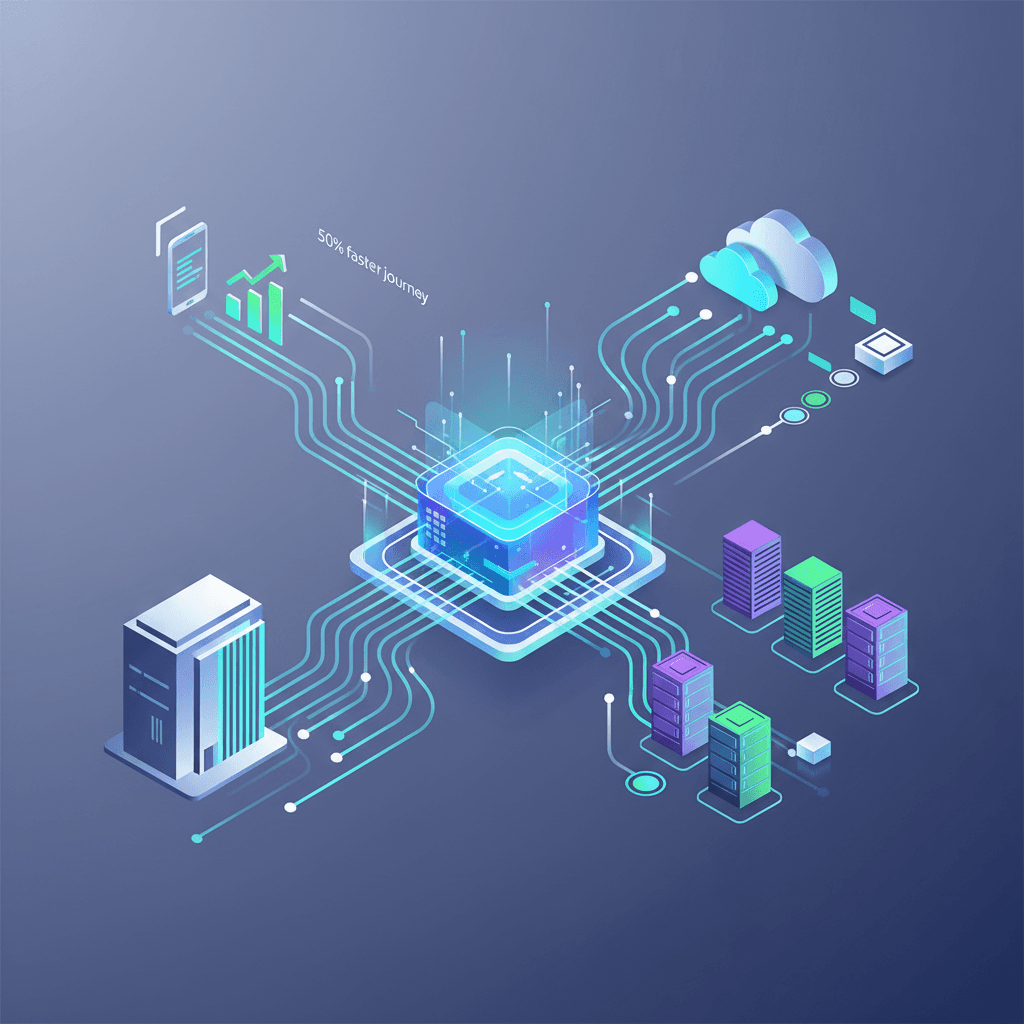

To overcome these hurdles, Unity Bank collaborated with IBM Consulting to deploy IBM Cloud Pak for Integration on a Red Hat OpenShift platform.[1][2] This initiative led to the creation of a centralized API hub designed to seamlessly manage the bank's entire API ecosystem.[2][3] The hub functions as a unified control plane, providing a standardized and secure method for discovering, deploying, and managing both internal and external APIs. A core component of this architecture is an advanced API Gateway, which facilitates smooth and secure integration between the bank's critical back-end systems and its various digital channels and operational workflows.[1] By creating this secure and scalable application backbone, the bank can now unlock the full potential of its digital assets, connecting existing applications and data regardless of their location. This transformation allows the bank's technology teams to move away from managing complex, point-to-point integrations and instead focus on building differentiated, value-added services for customers.

The business impact of this technological overhaul has been both significant and quantifiable. The primary achievement is a 50% reduction in the time-to-market for new APIs and the features they enable, allowing Unity Bank to innovate and iterate at a much faster pace than before.[1][2] This acceleration means that new digital products, from personalized loan services to integrated payment solutions, can reach customers in half the time. Complementing this speed is a substantial gain in operational stability and efficiency, evidenced by a nearly 30% improvement in the resolution time for API-related issues.[1] According to Yusuf Roopawalla, Chief Information Officer at Unity Small Finance Bank, this powerful and secure application backbone allows the institution to scale effectively and respond to customer needs in real time, freeing up teams to focus on the customer journey itself rather than the underlying technical complexities.[1][2]

Beyond immediate efficiency gains, the centralized API hub positions Unity Bank as a key player in the expanding world of open banking. By providing secure, standardized, and real-time access to business-critical data, the bank empowers a wider ecosystem of third-party developers, fintech partners, and corporate clients.[1][2] These partners can now more easily build their own value-added services that tap into the bank's core functionalities, fostering an environment of co-creation and innovation. This capability is essential for developing the hyper-personalized experiences and targeted product recommendations that modern consumers expect. As noted by IBM executives, the ability to seamlessly connect systems, applications, and data is no longer just a technical requirement but a distinct competitive advantage in a market where agility and collaboration are paramount.[1] This strategic approach to API management provides the foundation for future growth, enabling the bank to participate more fully in the API economy and adapt to the continuous transformation cycle of India's banking industry.

In conclusion, the collaboration between Unity Bank and IBM serves as a compelling case study in modernizing financial services technology for the digital age. By addressing the core challenge of API management through the creation of a centralized hub, Unity Bank has not only achieved dramatic improvements in speed and efficiency but has also fundamentally enhanced its capacity for innovation. The 50 percent reduction in time-to-market is more than a metric; it represents a strategic capability that allows the bank to compete more effectively and better serve its customers. This successful implementation of a robust, scalable, and secure API backbone provides a clear blueprint for other financial institutions seeking to navigate the complexities of a hybrid cloud world and unlock the transformative potential of an open, connected, and API-driven banking ecosystem.