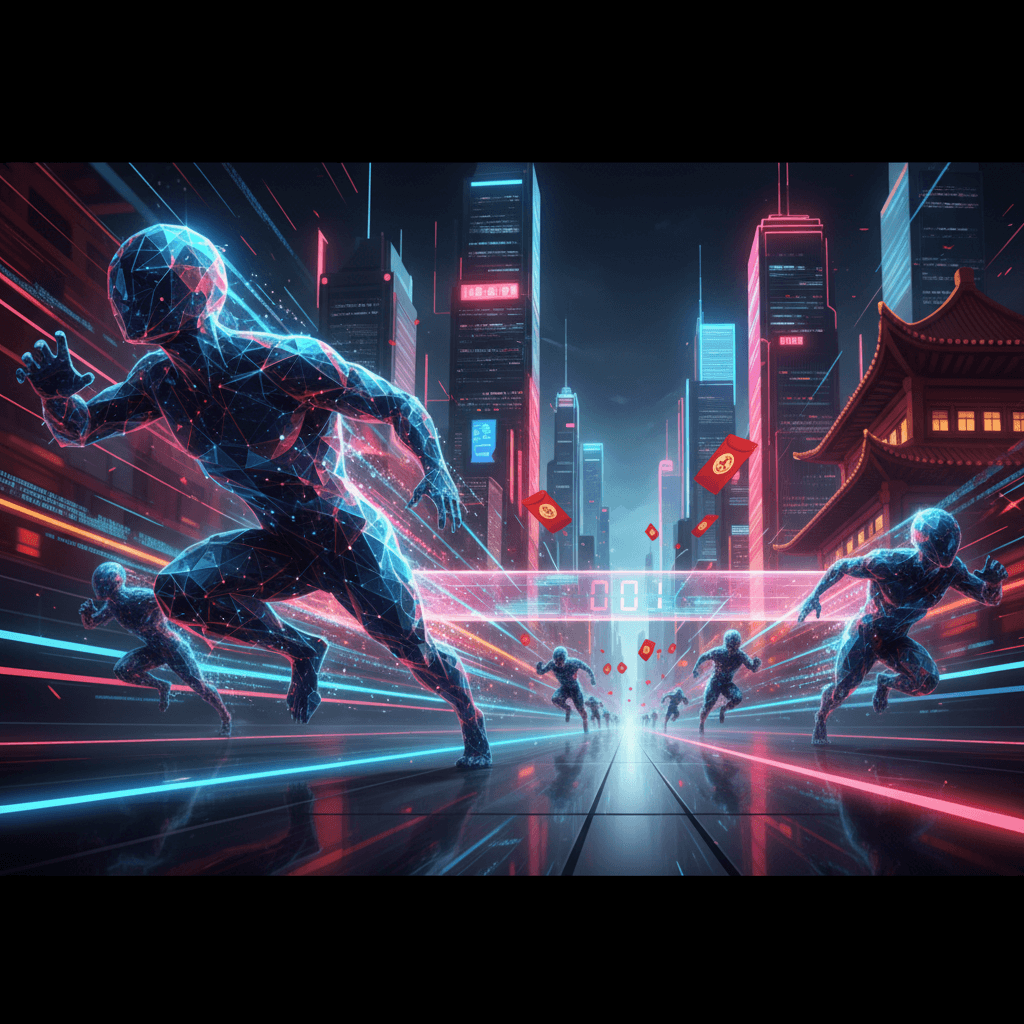

China's AI Titans Race to Ship New Models Ahead of Lunar New Year.

Lunar New Year deadline forces AI giants to ship flagship models and commit to half-billion-dollar consumer marketing budgets.

February 2, 2026

In a dramatic display of escalating competition, China's leading artificial intelligence laboratories and technology giants are engaged in a frantic sprint to roll out major new model updates just ahead of the Lunar New Year holiday, a period typically marked by national pause and extended travel. The rush underscores the high-stakes nature of the domestic AI race, where a brief gap in innovation can translate to a significant loss of market share, even as firms also seize the holiday for massive consumer marketing pushes. This accelerated pace of development is not merely about launching new products; it represents an aggressive positioning strategy by companies aiming to start the new year with a technological edge that rivals the global frontier.

A host of high-profile companies and well-funded startups are involved in this year's pre-holiday blitz. ByteDance, for example, is reportedly preparing to launch not one, but three new generations of flagship models, including the Doubao 2.0 large language model, the Seeddream 5.0 image generation model, and the Seeddance 2.0 video generation model, as it works to capitalize on the massive user base of its Doubao chatbot application, which had reached 163 million monthly active users by late last year.[1] Not to be outdone, e-commerce titan Alibaba is lining up its next-generation flagship, Qwen 3.5, which is said to offer strong capabilities in complex reasoning tasks, particularly in mathematical reasoning and code generation.[1] Meanwhile, dedicated AI labs like Beijing-based Zhipu AI are set to launch the fifth iteration of their flagship GLM model series, GLM-5, which is expected to bring significant improvements in agentic capabilities, coding, and creative writing.[2] Shanghai-headquartered MiniMax is also contributing to the flurry with the release of M2.2, a minor update to its M2.1 model that focuses on coding enhancements.[2] This concerted burst of activity follows earlier releases, such as Alibaba's Qwen3-Max-Thinking and Moonshot AI's Kimi 2.5 models, setting a torrid pace for the industry as the holiday approaches.[2]

The urgency to ship before the holiday is driven by a complex interplay of market dynamics, regulatory requirements, and the sheer momentum of an intensely competitive ecosystem. Historically, a successful pre-holiday launch, such as the one DeepSeek executed the previous year with its high-performance and low-cost R1 model, can send shockwaves through the global tech world and establish a company's position for the following year.[2][3] The window before the Lunar New Year—a period during which hundreds of millions of people travel and spend time with family—is also a crucial marketing battleground.[4] Major players are translating their model development into consumer-facing campaigns, with companies committing enormous sums to attract new users. Alibaba, for instance, has pledged to spend an estimated $431 million to draw users to its Qwen AI application with incentives like "large red envelopes" (digital cash gifts) distributed continuously during the festive period.[4] This triples the spending promised by rivals like Baidu and Tencent for similar AI chatbot promotions, mirroring a historical tactic used by tech companies, most notably Tencent in 2015, to gain ground in key areas like mobile payments.[4] The objective is not only to showcase technological capability but to embed the AI assistant into the daily lives of the vast Chinese consumer base, integrating it with existing ecosystem advantages like e-commerce, search, and social media.[5]

This relentless pace raises significant questions about the quality, safety, and long-term sustainability of AI development in the region. The drive to continuously match and outpace competitors, particularly in the domestic market, has created a pressure-cooker environment. One of the motivations behind the speed is the strategic advantage of being first to market with a new benchmark-setting model, forcing competitors to play catch-up.[6] However, this fast-moving landscape, described by some as a "free-for-all," also risks resource waste and an excessive focus on leaderboard rankings over real-world performance, a critique that has been leveled at some earlier model releases.[7][6] Conversely, the rapid iteration is seen by some as a sign that Chinese firms are innovating by doing "more with less," particularly in the context of persistent U.S. export controls limiting access to the most advanced AI chips.[8] The success of previous low-cost, high-performance models has already challenged the global consensus that vast infrastructure investments are the sole path to frontier AI development, leading to a "margin compression" trend that is being felt throughout the global AI ecosystem.[9]

The broader implications for the global AI industry are substantial. The sheer volume and speed of open-source and open-access models coming from China are beginning to reshape global standards and benchmarks.[9] With Chinese developers demonstrating an ability to rapidly close the gap with, and in some domestic benchmarks even claim to outperform, leading Western models, the narrative of a clear U.S. dominance in the foundational AI technology is being challenged.[10][11] Moreover, this intense domestic rivalry has also coincided with a notable boost to the financial markets, particularly in Hong Kong, where the start of the year saw a rush of AI-related IPOs by companies aiming to complete their deals before the extended holiday.[12] The rush to solidify technological and market positions before the break indicates a clear strategic view: the national holiday is a temporary pause in a race that will immediately resume with renewed ferocity. For the Chinese AI ecosystem, the ultimate goal is to translate this breakneck innovation speed into consumer and enterprise adoption, securing a foundational advantage for the Year of the Horse.[2]