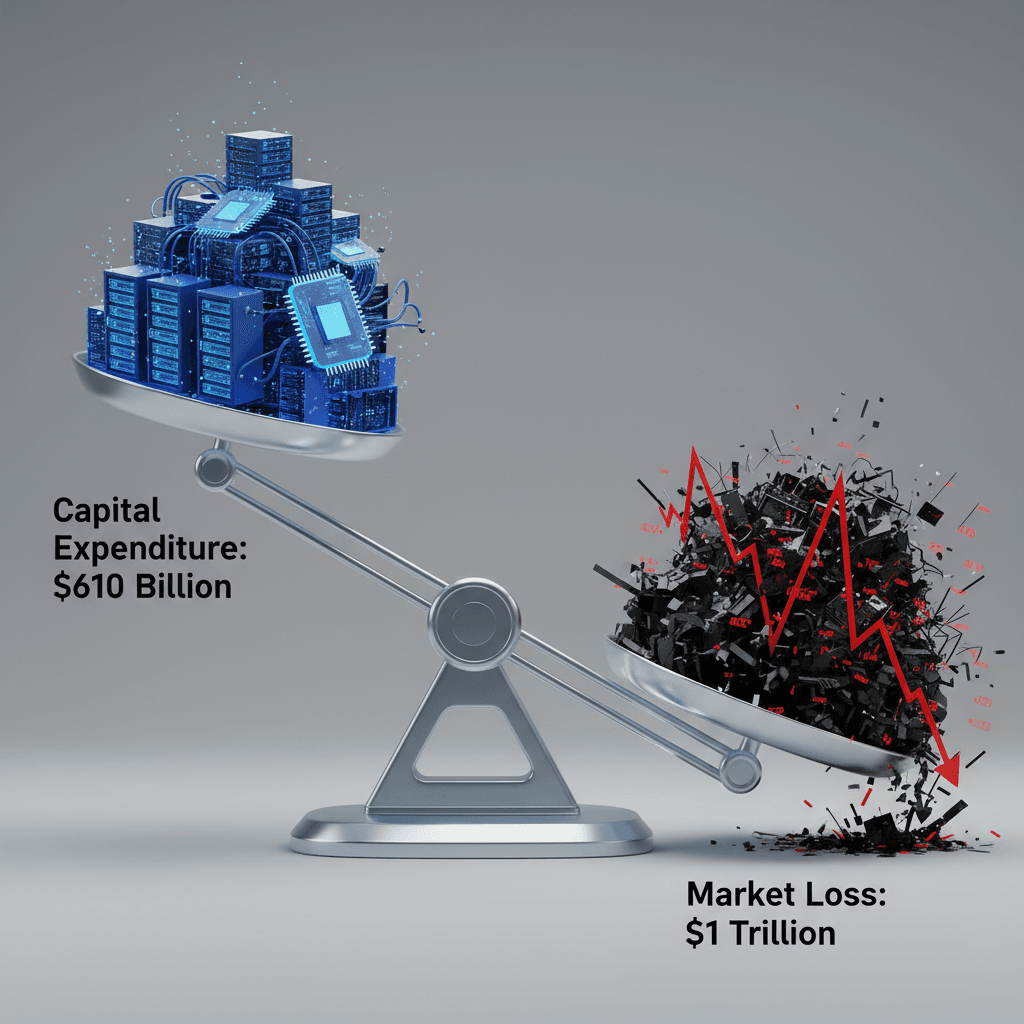

Big Tech Commits $610 Billion to AI, Loses $1 Trillion in Market Value.

The $610 billion AI infrastructure commitment sparks market panic over an "AI spending trap" and missing ROI.

February 6, 2026

The world’s largest technology companies have embarked on a capital expenditure campaign of historic proportions, committing unprecedented sums to dominate the nascent field of artificial intelligence, only to see the stock market respond with a sharp, nervous sell-off that erased hundreds of billions in market value. The paradox presents a critical inflection point for the AI industry: an undisputed technological future is being built on a financial foundation that Wall Street finds increasingly tenuous. Four tech giants—Alphabet, Amazon, Meta, and Microsoft—have signaled a combined capital expenditure package for the coming year of at least $610 billion, an outlay focused almost entirely on the infrastructure necessary to power the next generation of generative AI tools. Yet, in the immediate aftermath of these announcements, the companies collectively shed an estimated $950 billion to over $1 trillion in market capitalization, suggesting that investor patience for a massive spending spree without a clearly defined near-term return has finally worn thin.

The collective commitment of more than $610 billion for AI-related infrastructure in 2026 marks a staggering escalation in the technological arms race, representing an increase of nearly 70% from the previous year’s spending and more than double the expenditure from two years prior.[1] This capital is overwhelmingly earmarked for data centers, cutting-edge AI chips, and the complex networking equipment required to train and run increasingly sophisticated large language models.[2] Leading this historic investment is Amazon, which shocked Wall Street with a capital expenditure plan of approximately $200 billion, substantially exceeding market expectations, with the spend predominantly focused on its cloud unit, Amazon Web Services (AWS).[1][3] Alphabet followed closely behind, announcing an expected capital expenditure between $175 billion and $185 billion, nearly doubling the roughly $92 billion spent the year before, signaling an aggressive push to catch up in the AI infrastructure domain.[4][5] Meta and Microsoft also outlined massive plans, committing an estimated $125 billion and $105 billion, respectively, reflecting a unified belief across the sector that the race for AI compute capacity is a zero-sum, "winner-take-all or winner-takes-most" market.[6][1][7] This dramatic and simultaneous increase in CapEx across the sector indicates that each competitor views this massive investment not as an optional growth opportunity, but as an existential requirement to maintain their competitive position in the cloud and software markets.

Despite the promise of technological transformation, the stock market's reaction revealed deep-seated anxieties about the financial viability of this rapid buildout. Investors punished the shares of these hyper-spenders, driving down their combined market value by an amount nearly 50% greater than their total committed investment, sending a clear message that the long-term potential of AI is no longer enough to justify open-ended capital intensity. The central anxiety on Wall Street revolves around the "return on investment" (ROI) and the lack of a clear timeline for monetization.[8][3] Analysts and portfolio managers noted that, while management teams express confidence in long-term returns, the lack of near-term visibility on the actual revenue generated by AI workloads is spooking the markets.[3] For instance, one analysis suggested that the AI industry would need to generate approximately $650 billion in new annual revenue—an amount roughly equivalent to a monthly payment of nearly $35 from every existing iPhone user—simply to deliver a modest 10% return on the expected AI investments through 2030.[9] This calculation underscores the scale of the financial hole the industry is digging and the corresponding monumental revenue streams needed to justify it.

The market’s caution is heavily influenced by historical precedents, particularly the telecom and fiber buildout experience of the 1990s, where initial massive capital expenditures led to an over-expansion of capacity before the revenue curve could fully materialize, resulting in significant industry turmoil and financial losses.[9] This fear has given rise to the concept of an "AI spending trap"—a self-reinforcing cycle where Big Tech companies must continually boost spending to maintain the illusion of future AI profitability, as cutting back would signal a loss of confidence and potentially tank their stock prices further.[1] Furthermore, the nature of the AI race itself—where companies invest billions in AI startups like OpenAI, which then turn around and spend that capital on cloud services from the very companies that funded them—raises concerns about the true organic growth and sustainability of the revenue figures.[1] The enormous CapEx is also leading to rising debt issuance, a shift for firms that historically relied on cash, adding another layer of financial risk in an already volatile market.[10]

The cascading effect of this financial nervousness has spread beyond the hyperscalers, igniting a sell-off in the broader software sector.[4] The rapid advancements in generative AI are creating a widespread "disruption risk," where new tools could potentially upend established software business models and compress margins faster than incumbent companies can adapt.[4] This has created a bifurcated market sentiment: firms that are perceived to be winning the infrastructure race, such as chipmakers, have shown resilience, while many traditional software companies are grappling with a "sentiment contagion."[11][12] Interestingly, companies that have pursued a lower-CapEx AI strategy, such as Apple, have benefited from the market's new focus on profitability. Apple’s shares rose as it focused on device-based AI features, avoiding the massive cloud infrastructure investments of its peers, highlighting that the market is now prioritizing a clear, less capital-intensive path to AI monetization.[3] The unprecedented $610 billion commitment solidifies the AI revolution as the central investment theme of the decade, but the $950 billion market loss simultaneously confirms that Wall Street is moving past the hype phase. The market is no longer simply buying the promise of AI; it is now aggressively demanding tangible, profitable evidence of the technology’s worth.