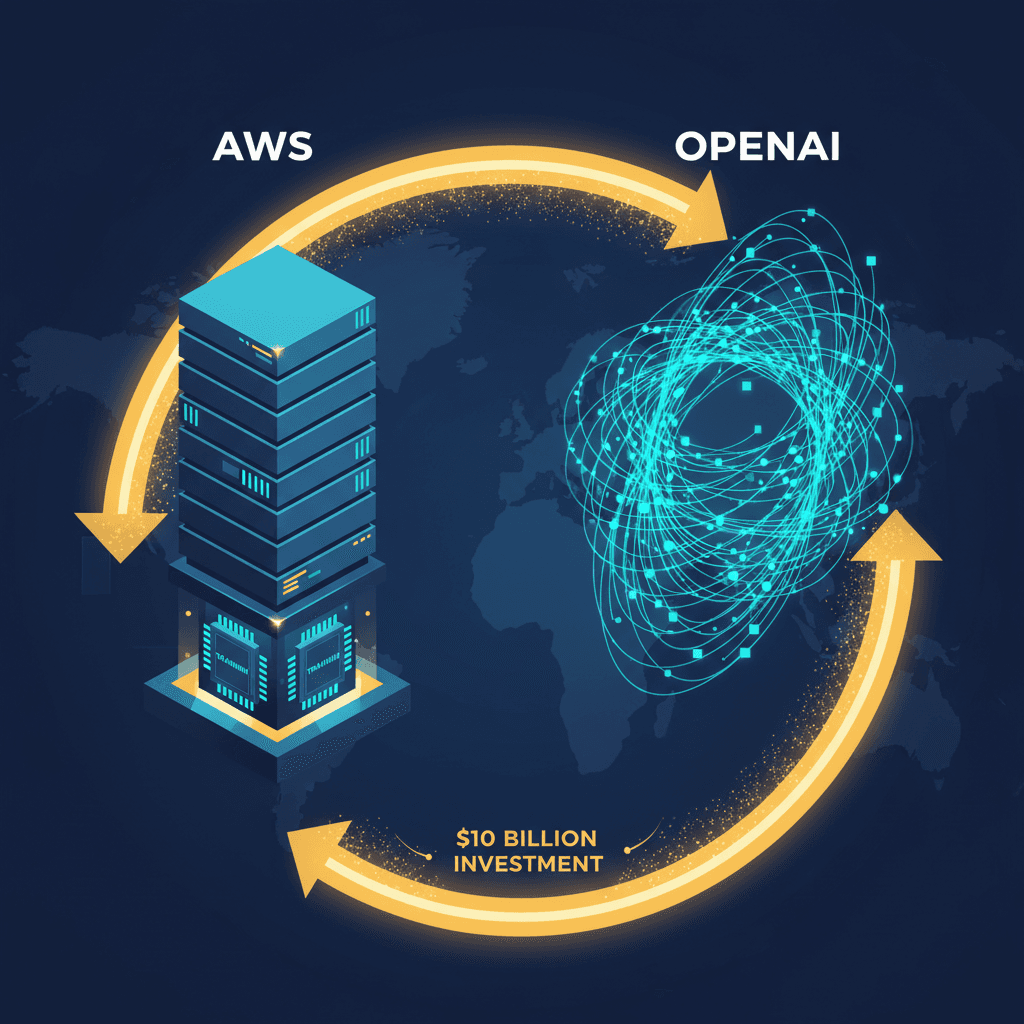

Amazon injects $10 billion into OpenAI, mandating spending on AWS cloud.

The $10 Billion Loop: Amazon’s investment demands guaranteed AWS revenue and validation for its custom AI chips.

December 17, 2025

In a startling turn that illustrates the high-stakes, circular economics of the generative artificial intelligence arms race, Amazon is reportedly in preliminary discussions to inject at least $10 billion into OpenAI, the company behind the popular ChatGPT.[1][2][3] This massive investment, which could push OpenAI’s valuation to more than $500 billion, is not a simple equity purchase, but is instead designed around a strategic, closed-loop financial structure.[1][2][3] The core premise is that Amazon provides the capital, and a significant portion of that capital is then required to be spent directly back on Amazon’s own infrastructure, namely Amazon Web Services’ (AWS) cloud capacity and its in-house proprietary AI chips.[1] This "billion-dollar loop" is a powerful and increasingly common tactic in the cloud industry, effectively allowing Amazon to buy guaranteed future revenue while simultaneously securing a key strategic position in the most influential AI firm outside of its direct rival, Microsoft.

The mechanics of this potential transaction reveal the true intent is not just ownership, but infrastructure dominance. The $10 billion equity investment would be contingent on OpenAI heavily adopting Amazon’s custom-designed AI accelerators, the Trainium chips, and renting considerable additional data center space from AWS.[1][3][4] For Amazon, this arrangement transforms a speculative financial outlay into a near-certain, multi-year revenue stream for its highly profitable cloud unit.[1][5] The money flows out to the AI developer, but then flows back to the cloud provider, recognized as revenue by AWS and recorded as capital expenditure by OpenAI.[1] This move is particularly aggressive as it comes just weeks after the two companies announced a separate, unprecedented seven-year agreement under which OpenAI committed to spending a staggering $38 billion on AWS computing services, a deal that at the time centered primarily on Nvidia chips.[1][3][4] The combined effect of these two agreements—the massive infrastructure commitment and the proposed $10 billion capital injection—cements AWS as a critical compute partner for OpenAI, injecting stability and scale into the AI startup’s colossal infrastructure needs.[1][6]

This strategic maneuver is a direct response to the escalating AI Cloud Wars, a tri-party battle for supremacy between AWS, Microsoft Azure, and Google Cloud.[7][8] Microsoft was the first to leverage this playbook, having invested billions in OpenAI since 2019, culminating in a 27% stake and an exclusive long-term partnership that granted Azure the sole right to commercialize OpenAI’s most advanced models to its cloud customers until the early 2030s.[2][9] This tight integration has been a primary driver of Microsoft’s rapid growth in the generative AI space, allowing Azure's growth rate to outpace its rivals in recent periods.[8] Amazon, despite remaining the overall leader in the global cloud market by revenue, has seen its competitors aggressively gain ground fueled by AI workloads.[8][10] In an effort to secure its own position, Amazon had already poured at least $8 billion into Anthropic, a prominent OpenAI competitor founded by former OpenAI researchers.[1][3][5] The dual investment strategy—simultaneously backing both the first- and second-most prominent foundation model developers—provides AWS with a defensive hedge: the company is positioned to collect vast infrastructure fees regardless of which leading AI firm achieves long-term dominance.[1][3]

Central to the negotiation is the requirement for OpenAI to integrate Amazon’s Trainium chips, which represent the company’s biggest strategic play in the hardware sector.[3][9] The entire generative AI industry currently relies heavily on specialized Graphics Processing Units (GPUs), with Nvidia holding a near-monopoly on the high-end market for training large language models.[6] By insisting that OpenAI, one of the world's most demanding AI users, adopt Trainium, Amazon is seeking to rapidly validate its custom silicon strategy and establish a credible, cost-effective alternative to Nvidia’s processors.[3][4][9] Amazon officials argue their in-house chips can offer comparable performance at a lower cost, which is a powerful incentive for OpenAI, an organization facing one of the largest infrastructure capital expenditures in corporate history.[1][4] For Amazon, securing a commitment from a flagship customer like OpenAI would not only increase the scale and production of Trainium but also create a crucial reference point, making it easier to convince other enterprise customers and AI developers to switch from the industry standard.[5][4]

The preliminary nature of the talks should not obscure the profound implications of this deal for the AI industry. It underscores a fundamental financial dynamic where the providers of the foundational computing infrastructure—the cloud giants—are increasingly becoming the primary winners in the AI boom.[1][10] The exorbitant capital needed to train and run state-of-the-art models means AI developers, even those with multi-billion dollar valuations like OpenAI, remain deeply reliant on the financial and physical resources of the cloud vendors.[1] This circular funding model, which Wall Street analysts have noted is becoming a structural feature of the AI market, transfers money from the cloud provider's balance sheet, through an investment vehicle, and back into the cloud provider’s revenue line as consumption.[1][6] The transaction positions Amazon Web Services as a universal infrastructure provider, ensuring that even as its rival Microsoft deepens its exclusive application layer access with OpenAI, AWS maintains a vital, non-exclusive role as the engine of OpenAI's massive compute operations. The negotiations solidify the narrative that the AI gold rush is, first and foremost, a massive boom for the companies that sell the shovels and the picks.[5]