AI Drives Mphasis $428M Wins; One-Time Labor Charge Cuts Profit.

Robust growth and $428M TCV masked by a one-time labor code hurdle shaking the IT sector

January 22, 2026

The financial narrative of Mphasis's latest quarterly performance presents a complex picture of robust operational momentum overshadowed by a one-time regulatory hurdle, reflecting a wider trend across the Indian information technology sector. While the company successfully navigated a challenging macroeconomic environment to achieve sequential revenue growth and substantial new deal wins, its net profit was dented significantly by the implementation of a sweeping change in the national labor code. This financial quarter serves as a microcosm for the industry, highlighting the dual pressures of global demand volatility and domestic regulatory adjustments at a time when strategic investment in next-generation technologies, particularly Artificial Intelligence, is paramount.

Mphasis reported a consolidated revenue increase of 2.6% quarter-on-quarter, demonstrating an underlying stability and demand for its services, which are focused on cloud and cognitive capabilities. The revenue growth trajectory signals that the company’s strategic push into specialized domains continues to resonate with its client base, predominantly in the banking, financial services, and insurance (BFSI) segments, where digital transformation initiatives remain a priority. This modest but consistent sequential rise underscores the firm's resilience in an industry grappling with broader global spending cuts and delayed decision-making among large enterprises. Crucially, the operating margin for the quarter stood at 15.2%, a figure that shows disciplined cost management even amidst the pressures of wage inflation and the need to invest in a future-ready workforce.[1][2][3]

The standout performance metric, however, was the total contract value (TCV) wins, which hit a substantial $428 million for the quarter. This figure is a critical indicator of the company’s future revenue pipeline and market relevance, suggesting that large enterprises are continuing to award significant mandates to Mphasis for long-term engagements. The nature of these wins, including multi-year transformations with a large US bank focusing on Financial Crimes and Anti-Money Laundering (AML), and a partnership with a top healthcare company utilizing the Mphasis Javelina platform, indicates a strong focus on high-value, domain-intensive service lines. The strong TCV performance suggests that the underlying business momentum remains healthy, positioning the company for accelerated growth once the external economic climate stabilizes.[2]

The primary drag on the profitability was a one-time exceptional item resulting from the new national labour codes. This regulatory shift mandates a structural change in how companies calculate employee benefits by redefining the 'wage' component, effectively increasing the base on which statutory contributions are calculated. The core of the impact stems from a requirement that basic pay must account for at least 50% of an employee's total cost to the company, leading to a rise in mandatory pay-outs tied to statutory contributions such as gratuity and leave-related benefits. The IT sector, with its employee-heavy cost structure, felt a particularly sharp impact. Mphasis accounted for this change with an exceptional charge of INR 355 million (approximately $4.3 million), which directly suppressed the quarter's net profit, resulting in a 5.7% sequential decline.[1][4][5][6][2]

This statutory adjustment is not unique to Mphasis; it has created a ripple effect across the entire IT industry, with major peers also reporting considerable one-time costs. Industry analysis indicates that the top six IT services firms collectively absorbed a hit of approximately ₹5,400 crore (around $650 million) to their quarterly earnings due to this one-time provisioning. For mid-tier IT companies, the impact, as a percentage of revenue, was even more pronounced. Beyond the immediate one-time cost, this change is projected to lead to a small but persistent increase in recurring employee expenses—potentially raising overall wage-related costs by up to 5% and placing sustained pressure on operating margins across the sector in subsequent quarters. The industry is now grappling with how to strategically absorb these higher employee costs while remaining globally competitive and maintaining margin guidance.[7][8][6]

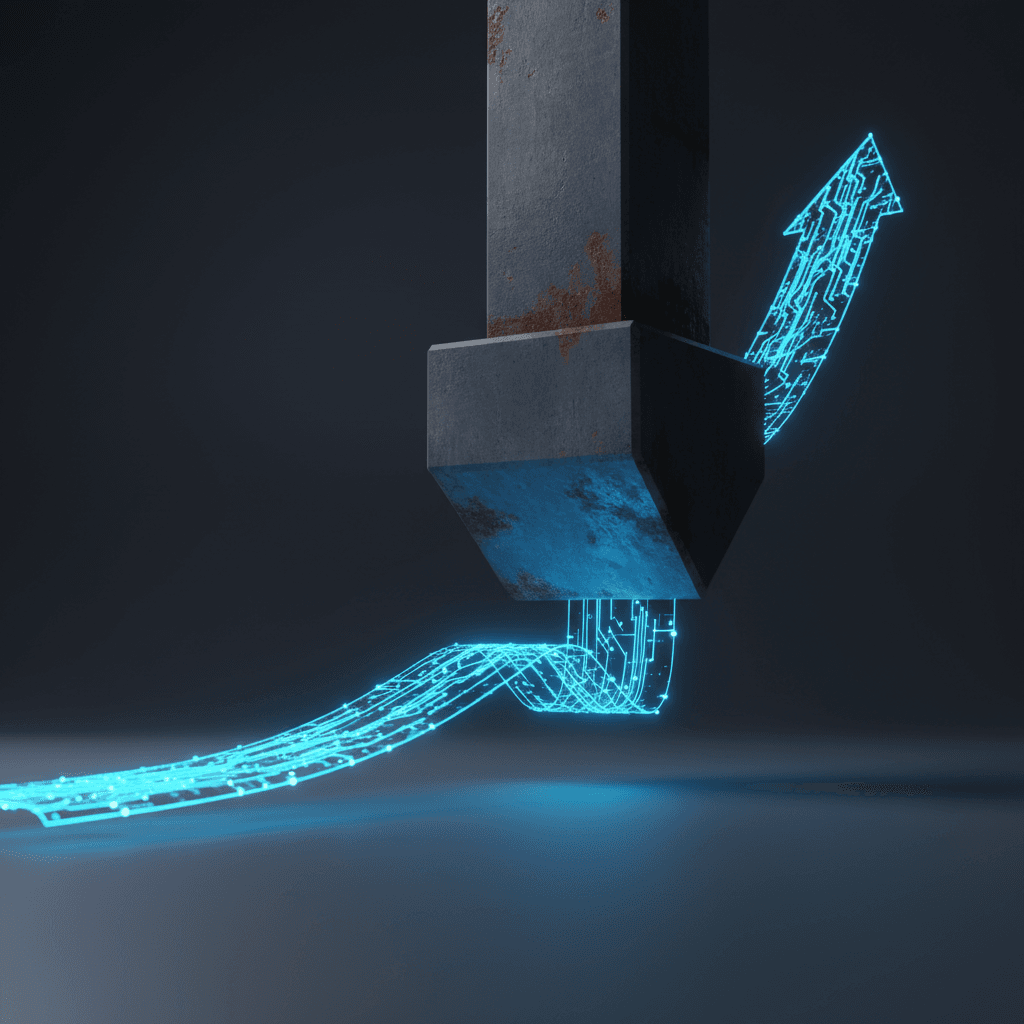

The implication for the AI industry, which Mphasis is heavily invested in, is critical. The exceptional financial charge forces a reallocation of capital and attention, potentially diverting resources that might otherwise be funneled into future-proofing investments like AI research and development. However, Mphasis’s leadership has emphasized that AI is driving a fundamental shift that redefines and expands the addressable market, indicating an unwavering strategic focus. The company is actively infusing its NeoZeta™ and NeoCrux™ AI platforms into its solutions, which management suggests is leading to a considerable uptick in AI adoption as evidenced by the growth in deal wins and pipeline. The strong TCV wins, many of which involve advanced digital transformation, suggest that clients are prioritizing services that incorporate these cognitive and AI capabilities, recognizing their long-term value despite global economic uncertainties. This strategic pivot ensures that while current-quarter profitability takes a temporary statutory hit, the foundation for future growth remains rooted in high-demand, high-margin, next-generation service offerings.[9]

Looking ahead, the market will be closely watching how Mphasis and its peers manage the ongoing, though smaller, recurring impact of the new labor codes on their margins. The key to mitigating this sustained pressure lies in increasing operational efficiencies and driving revenue growth from higher-value services, which is where AI and cognitive technologies become a central component of the business model. By embedding proprietary AI platforms and solutions, Mphasis can improve productivity and automate tasks, theoretically offsetting rising labor costs over time. The company’s ability to sustain its large TCV wins and execute on its AI strategy will ultimately determine its long-term financial health, providing a clear path to returning its net profit growth in line with its strong underlying revenue and deal momentum, thereby transforming a short-term regulatory headwind into an accelerant for technological restructuring and efficiency.