OpenAI's Paradox: User Growth Soars, But Needs $207 Billion

Explosive user growth for ChatGPT clashes with a $207 billion funding gap, exposing AI's battle against colossal computational costs.

November 27, 2025

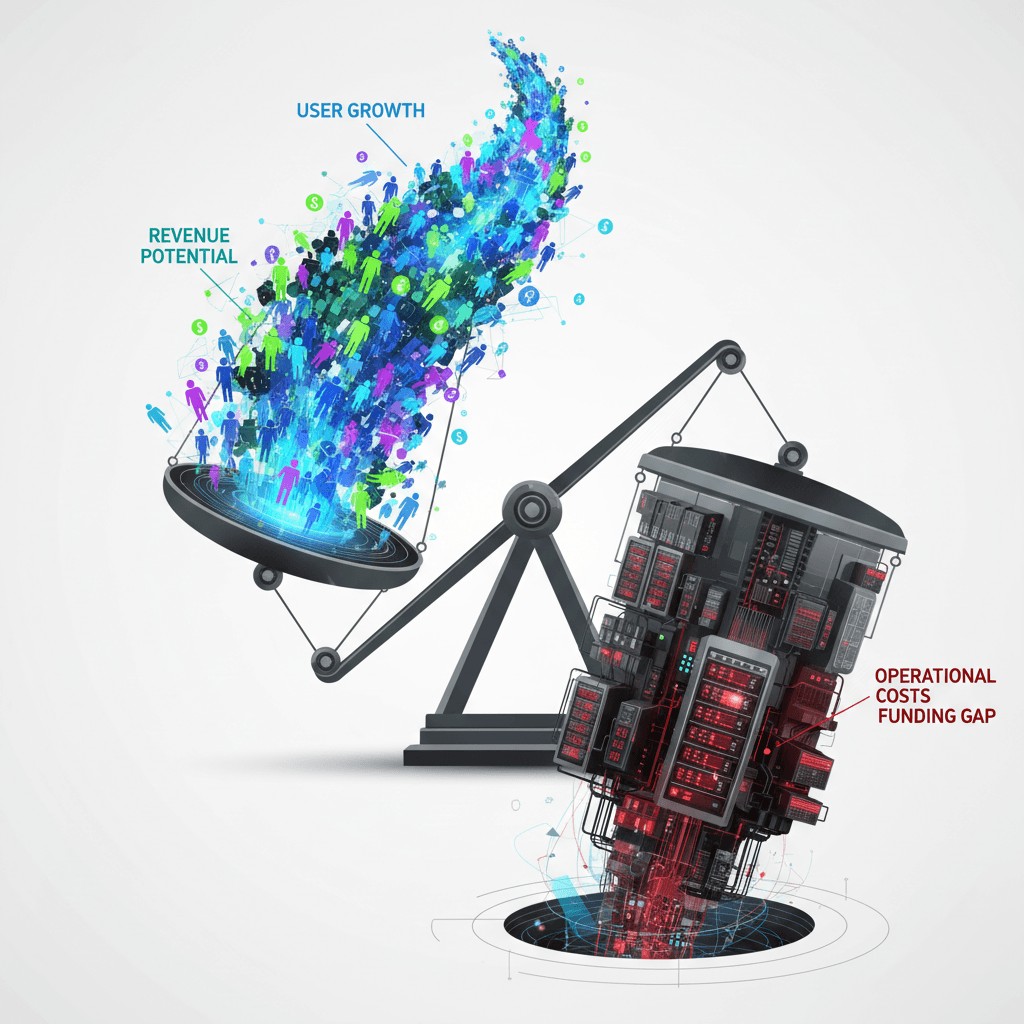

A new analysis presents a stark paradox at the heart of the artificial intelligence boom: while OpenAI projects it will attract 220 million paying subscribers to its ChatGPT service by 2030, the company is not expected to be profitable by then and faces a monumental funding gap. According to a report from banking giant HSBC, the AI pioneer will need to secure an additional $207 billion in financing by the end of the decade simply to cover the colossal expense of its computing infrastructure.[1][2][3] This forecast paints a sobering picture of the immense financial hurdles facing even the most prominent players in a field defined by a cash-intensive race for technological supremacy.[1][2] The dueling projections of massive user growth against a backdrop of staggering losses highlight a fundamental question about the long-term economic viability of the generative AI industry.

OpenAI's internal forecasts reveal a company poised for unprecedented scale in user adoption. The firm anticipates that by 2030, its weekly active user base for ChatGPT will swell to an estimated 2.6 billion people.[4][5][6] Of those users, the company projects 8.5%, or around 220 million, will be paying subscribers, a significant increase from the roughly 35 million paying users reported in mid-2025.[4][5][6] This level of paid adoption would position ChatGPT among the largest subscription businesses in the world. Bolstering this growth, OpenAI's annualized revenue is on a steep upward trajectory, expected to hit approximately $20 billion by the end of 2025.[4][5][7] To further drive revenue, the company plans to diversify its income streams beyond subscriptions, aiming for new products in areas like shopping and advertising to account for about 20% of its revenue.[4][5][7]

Despite this optimistic growth narrative, the analysis from HSBC underscores the crushing weight of operational costs that threaten to keep profitability out of reach. The primary driver of this financial strain is the soaring cost of computing power required to train and run OpenAI's sophisticated models.[1][2][8] HSBC analysts warn that the company's infrastructure demands will vastly outpace its ability to generate cash.[1][2] Between now and 2030, OpenAI is projected to incur an estimated $792 billion in cloud and AI infrastructure costs.[1][2][9][3] A significant portion of this, around $620 billion, is expected to be for data-center rentals alone.[1][10][2] These staggering figures, which could see total compute commitments rise to $1.4 trillion by 2033, are informed by OpenAI's recent massive, long-term cloud contracts, including a $250 billion deal with Microsoft and a $38 billion deal with Amazon.[1][2][11][9][3][12] Even with revenues projected to potentially exceed $213 billion by 2030, the sheer scale of these infrastructure expenses creates the forecasted $207 billion funding shortfall.[1][2]

The financial challenges facing OpenAI are not unique but are emblematic of a broader, industry-wide reality. The development of frontier AI models is a capital-intensive endeavor "beyond any technology trend in history."[1][2] The process requires immense computational resources, including thousands of high-end GPUs, massive data centers that consume vast amounts of electricity, and the high salaries of top research talent.[13][8][14][15][16] This has raised concerns among some observers about a potential "AI bubble," where valuations and investments are outpacing a clear path to profitability.[10][17] Intense competition from other well-funded labs, such as Google and its Gemini models and the Amazon-backed Anthropic, further fuels the spending fire.[8][12][18] Each company must continuously pour billions into research and development simply to maintain its competitive edge, creating a cycle of escalating costs across the sector.

Ultimately, the trajectory of OpenAI presents a critical test case for the entire generative AI industry. The central conflict between explosive user growth and crippling operational costs exposes the fragile nature of current business models. While the company is successfully building a global user base, its path to financial sustainability is far from certain and appears to be subsidized by investor capital for the foreseeable future.[3] This dynamic raises the question of who the ultimate financial winners of the AI revolution will be. Some analysts suggest that the primary beneficiaries may not be the AI model developers themselves, but rather the infrastructure providers—the companies supplying the essential "picks and shovels" like cloud services and semiconductor chips.[17] For OpenAI and its rivals, the challenge is clear: they must either find a way to dramatically increase revenue per user or achieve radical breakthroughs in computational efficiency to close the daunting gap between their ambitious vision and the colossal price tag required to achieve it.

Sources

[2]

[3]

[4]

[6]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

[17]

[18]