Nvidia Commits $20 Billion to OpenAI, Forging Critical Hardware Alliance

Strategic $20 billion deal secures Nvidia’s GPU dominance but highlights OpenAI’s push to diversify hardware.

February 4, 2026

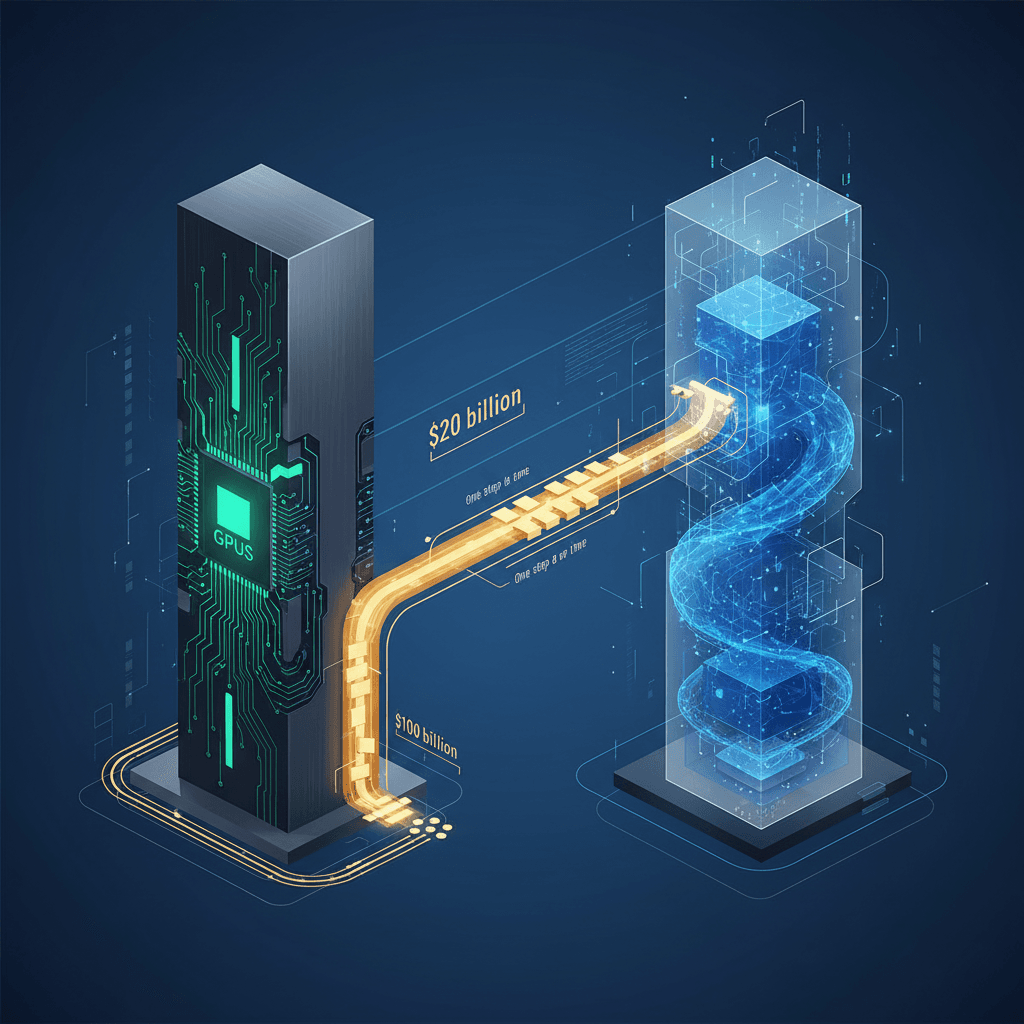

A reported investment of $20 billion by chip-making behemoth Nvidia in OpenAI is poised to solidify one of the most crucial commercial and technological partnerships in the artificial intelligence landscape, even as the scale of the deal is significantly pared back from initial whispers of a colossal $100 billion commitment. The anticipated funding is part of OpenAI’s latest fundraising round, which is looking to secure as much as $100 billion in total capital and could reportedly value the ChatGPT creator at approximately $830 billion.[1][2][3] While the $20 billion figure, if finalized, would mark Nvidia's single largest equity commitment to date in the AI startup, it represents a substantial recalibration from a non-binding letter of intent signed in September, which had projected an investment of up to $100 billion to support OpenAI's massive AI infrastructure buildout.[4][5][6][7] This reduction was accompanied by a clear clarification from Nvidia Chief Executive Jensen Huang, who publicly stated that the $100 billion figure was "never a commitment" and that the company would assess any funding in stages, proceeding "one step at a time."[4][8][9][7] The downshifting of the commitment and the public clarification follow reports of internal deliberation within Nvidia over the sheer size of the original proposal and questions concerning the financial discipline of the AI research lab.[4][10]

The context surrounding the revised investment has drawn fresh scrutiny to the dynamic, and at times complicated, relationship between the two AI titans. Reports of tensions emerged following the initial $100 billion proposal, suggesting internal friction at Nvidia and indicating that OpenAI had expressed dissatisfaction with certain aspects of Nvidia's latest AI chips, particularly their performance for "inferencing," or running already-trained AI models.[2][11][12] These reports suggested a potential challenge to Nvidia's hardware dominance, which has been indispensable for the "training" phase of large language models.[11][13] However, leaders from both companies moved quickly to publicly reaffirm their collaboration. Nvidia’s Huang dismissed reports of a strained partnership as “nonsense” and insisted that “everything is on track,” while OpenAI CEO Sam Altman posted on a social media platform that his company “love[s] working with NVIDIA” and that the chipmaker “make[s] the best AI chips in the world.”[8][11][14][13] Despite these public assurances, the fact that OpenAI has reportedly been exploring alternatives with chipmakers like Cerebras and Groq for a percentage of its inference computing needs highlights the company's efforts to diversify its hardware supply chain and secure the best performance for its rapidly evolving product roadmap.[12][13]

The structure of the investment itself is indicative of a broader trend of "circular funding" that has become a defining characteristic of the AI boom, where a hardware supplier strategically invests in a key customer who then uses that capital to purchase more of the supplier’s products.[4][8] For Nvidia, the motivation is clear: solidifying a substantial financial stake in the market leader of generative AI ensures a long-term, high-volume customer for its highly coveted Graphics Processing Units (GPUs), which remain the essential building blocks for training and deploying AI models.[4][9] The investment acts as a powerful strategic hedge against the potential for its largest customer to rely heavily on self-designed chips or competitors' hardware in the future, securing future demand for the Vera Rubin platform and other advanced systems.[4][6] OpenAI, in turn, secures a significant tranche of the $100 billion it seeks, enabling it to fund the construction of the colossal data center capacity—once estimated at a minimum of 10 gigawatts of power—necessary to pursue its goals of building next-generation AI models and eventually deploying superintelligence.[8][7][10]

Nvidia’s decision to commit a "huge investment," potentially its largest ever, in a staggered, measured approach as signaled by the "one step at a time" motto, reflects a cautious but firm long-term strategic vision.[9][7] This phased commitment allows Nvidia to maintain greater control and optionality in a rapidly changing and fiercely competitive market. The chipmaker is in an enviable position as the indispensable supplier of AI compute power, able to avoid the high brand risk associated with the end products, yet it must carefully manage its relationships with both its biggest customers and its competitors.[9] The investment, though smaller than initially discussed, also positions Nvidia alongside other major technology firms vying for a deeper strategic connection with OpenAI, including Amazon and SoftBank Group, which have also held discussions about potential investments as high as $50 billion and $30 billion, respectively, in the same funding round.[1][3][15] This competitive race to partner with OpenAI highlights the critical importance of the AI model developer to the future of the technology industry, underscoring the belief that a close relationship with the AI giant provides a crucial competitive edge.[1][11][15]

Ultimately, the reported $20 billion investment in OpenAI, a move the Nvidia CEO stated they are "absolutely" happy to make, is more than just a financial transaction; it is a declaration of commitment to the dominant player in the foundational AI model space.[9] While the initial $100 billion proposal may have been a grand vision that failed to materialize in its entirety, the substantial $20 billion commitment ensures the continued, deep intertwining of the world's leading AI chipmaker and the world's most talked-about AI research lab. The carefully worded "one step at a time" approach is a pragmatic move to manage risk and scale, but the sheer size of the investment underscores the continuing, massive demand for Nvidia's hardware and its unparalleled strategic leverage in the global race for artificial general intelligence.[4][9] The implications extend beyond the two companies, signaling to the wider industry that the high-stakes capital expenditures required for frontier AI development will continue to blur the lines between venture capital, strategic partnership, and hardware procurement for the foreseeable future, potentially attracting more regulatory attention to the concentrated nature of the AI supply chain.[4]

Sources

[5]

[8]

[9]

[11]

[12]

[13]

[14]