Insurance CEOs Aggressively Bet on AI Revenue Despite Skills Crisis

Insurance executives aggressively bet on AI for revenue growth, but a critical skills gap threatens a systemic crisis of readiness.

January 29, 2026

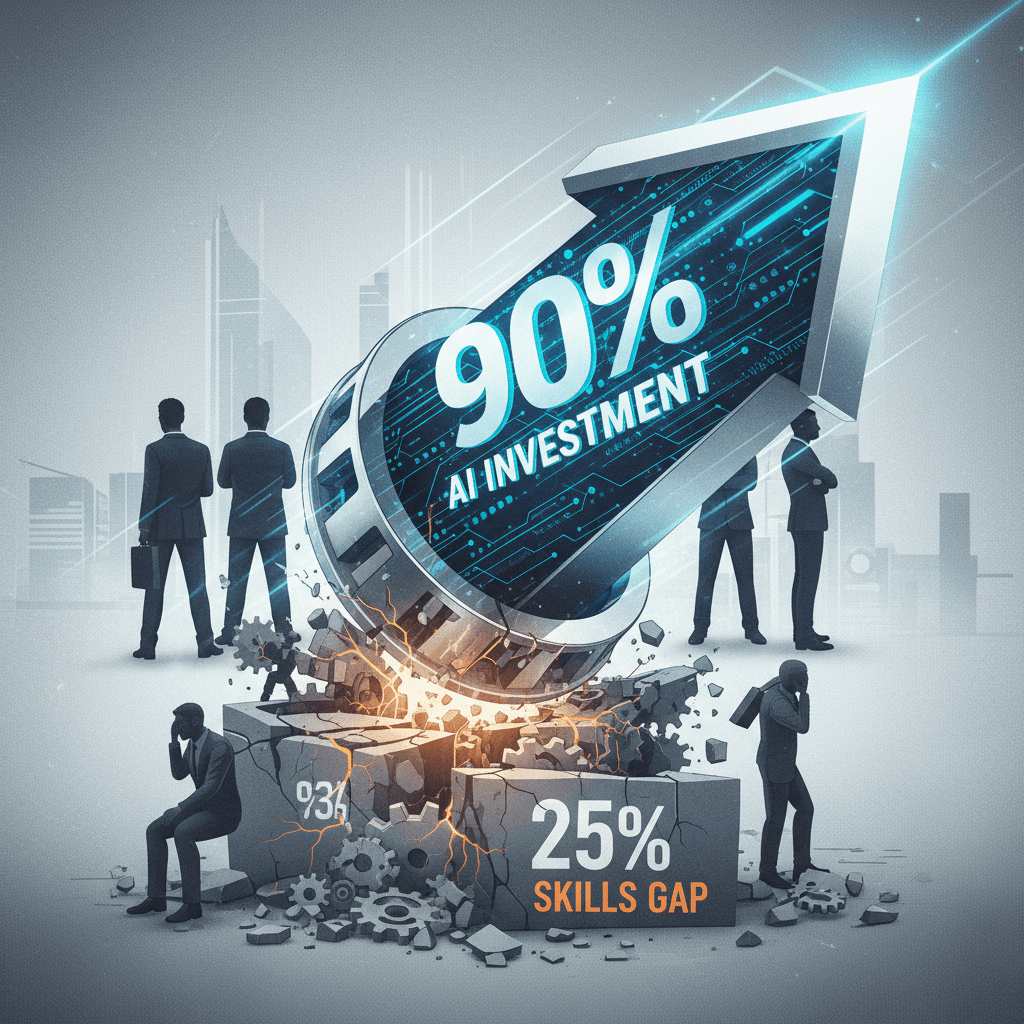

Global insurance executives are aggressively increasing their financial commitment to artificial intelligence throughout the coming year, underscoring a strategic shift that views AI not just as a tool for efficiency but as the primary engine for future revenue growth. This significant acceleration in spending, however, is proceeding directly into the headwind of a widening skills and capability gap within the industry's own organisations, creating a high-stakes paradox for the multi-trillion-dollar sector. New research from Accenture's comprehensive "Pulse of Change" poll, which surveyed 3,650 C-suite leaders across 20 countries and industries, highlights this determined push, revealing that fully 90% of senior insurance executives plan to increase their AI investments during the coming year.[1][2][3] The findings paint a picture of a sector that is moving decisively past the pilot-project phase and placing a major bet on technology to redefine its core business model.

The prevailing mindset among insurance leadership marks a distinct pivot from the traditional focus on cost reduction to a strategy centred on market expansion and new growth vectors. A commanding 85% of insurance executives now view AI primarily as a revenue driver, seeing greater benefits for growth than for simple cost reduction, cementing its status as a core component of competitive advantage rather than just an expense-cutter.[1][2][3] This confidence is so pronounced that leaders are exhibiting an unprecedented level of conviction in the technology's transformative power, even in the face of broader market uncertainty. When asked to consider a scenario where a potential "AI bubble" were to burst, 47% of executives stated they would still increase their AI investments, while 37% said they would increase hiring, demonstrating a deep-seated belief in AI as a foundational technology regardless of short-term market fluctuations.[1][2] This bullish outlook is translating into real-world enterprise-scale deployment. The survey indicates that 34% of insurance organisations are now actively deploying AI agents across multiple functions, signifying that AI is rapidly exiting the experimental lab. Furthermore, nearly a third of businesses, 29%, are already redesigning their fundamental, end-to-end processes with AI at the core, indicating a structural commitment that moves beyond superficial adoption.[1][3] The practical use of generative AI tools is also on the rise among the C-suite itself, with almost one-third of leaders using them daily, and 57% utilising them at least once a week, suggesting an internal acclimatisation at the highest levels of management.[1][2]

Despite the clear consensus on investment and the aggressive move toward enterprise-scale deployment, a critical impediment threatens to stall the transition from potential value to realised returns: the skills-and-talent gap. The Accenture research identified skilled talent shortages as a primary obstacle, with a quarter (25%) of executives citing it as the main factor limiting their ability to extract full value from their AI initiatives.[1][3] This concern over human capital matches the level of concern regarding poor integration between AI initiatives and core business strategy, which was also cited by 24% of respondents, indicating a systemic challenge that spans both people and process.[2][3] This skills shortage is not a passive problem; it is a direct consequence of a failure to proactively prepare the workforce for an AI-driven environment. The data highlights a significant disconnect between the scale of investment and the level of internal readiness, showing that a mere 24% of insurance organisations have embedded continuous learning programmes specifically related to AI.[1][3] The situation is even more stark concerning structural workforce planning, with fewer than one in ten executives—a minuscule 5%—reporting that their organisations are redesigning job roles to support and enable AI adoption.[1][2] This gap is becoming the central chokepoint, with one report suggesting that a significant portion of leaders across the broader business landscape now describe digital and AI capability as their main internal weakness, underscoring the severity of the human capital issue in translating technological potential into tangible business outcomes.

The market context further solidifies the high-stakes nature of this AI transition. As an industry inherently rich in data but traditionally slow to modernise, the upside of advanced intelligence systems has become impossible to overlook. The focus is increasingly shifting toward "vertical AI"—models specifically trained on insurance-centric data and workflows, promising more confident execution, fewer errors, and faster decisions across critical functions like underwriting, servicing, and customer engagement.[4] Top-tier insurers are actively seeking new ways to leverage their massive data sets to improve operational efficiency and gain a deeper understanding of risk.[5] This activity is mirrored in the Insurtech market, which analysts project will continue its exponential growth, with the global market expected to reach an estimated $23.5 billion within the current year and is forecast to rocket to $132.71 billion by the end of the next decade, representing a compound annual growth rate of over 24%.[4] However, for all the bullish investment and strategic redesign, the industry must still prove the financial thesis. According to data from another major reinsurer, while insurers are allocating between 3% and 8% of their IT budgets to AI development, fewer than 5% have publicly disclosed any measurable financial impact from these deployments.[6] This metric underscores the challenge: the industry has moved beyond proof-of-concept, but it has not yet consistently achieved clear, documentable return on investment at scale.

In conclusion, the insurance sector's collective decision to aggressively invest in AI represents a definitive vote of confidence in the technology's ability to drive a revenue-led transformation. The 90% investment figure is a clear signal to the AI industry that insurance is entering a period of hyper-adoption, becoming a primary market for the development and deployment of enterprise-grade AI agents and vertical-specific models. The fundamental success of this transition, however, will be determined not by the size of the investment budget, but by the executives' willingness to close the glaring human capital gap. With a quarter of leaders citing skilled talent as their main limitation and minimal resources currently directed toward upskilling and job redesign, the industry is effectively trying to pour a high-octane fuel—AI—into a system that is unprepared to handle its velocity. The real competitive differentiator will not be who purchases the most advanced AI, but which organisations are most successful in adapting their people and processes to use it effectively.