Cognizant's AI Strategy Drives 40% Large Deal Growth, Crushes Q3 Forecasts

AI strategy and a 40% surge in large deals power Cognizant's exceptional Q3, beating forecasts.

October 29, 2025

Cognizant Technology Solutions showcased a period of robust growth and strategic momentum in its third-quarter 2025 financial results, posting revenues of $5.42 billion, a significant 7.4% increase from the previous year.[1][2][3] This performance, which translates to 6.5% growth in constant currency, surpassed the company's own guidance and beat Wall Street expectations.[1][4][5] The IT services giant also reported an 11% year-over-year rise in adjusted earnings per share to $1.39, signaling strong operational efficiency and profitability.[1][6] A key highlight of the quarter was a substantial 40% year-to-date increase in the total contract value of large deals, underscoring the success of its strategic initiatives.[1][7][8] Buoyed by these results, Cognizant raised its full-year revenue growth guidance to a range of 6.0% to 6.3% in constant currency, reflecting confidence in its continued business transformation and market position.[1][9][7] Company leadership attributed the strong performance to broad-based growth across geographies and a strategic focus on artificial intelligence, which is increasingly converting into significant client contracts and driving future growth prospects.[1][10]

The financial strength demonstrated in the third quarter was comprehensive, with growth noted across all business segments and a particularly noteworthy performance in North America.[1][9][6] This marked the company's fifth consecutive quarter of year-over-year organic revenue growth and its strongest sequential organic growth since 2022.[1][11] While GAAP diluted earnings per share saw a decline to $0.56, this was primarily due to a one-time, non-cash income tax expense that negatively impacted the figure by $0.80 per share.[1][9][6] Operationally, the company showed improved efficiency, with the adjusted operating margin expanding by 70 basis points year-over-year to 16.0%.[1][6] Recent acquisitions also played a role in the positive results, contributing approximately 250 basis points to the year-over-year revenue growth.[1][7] Cognizant's financial health was further demonstrated by its commitment to shareholder returns, having deployed $1 billion in share repurchases through the third quarter.[1][9] The company also continued to expand its workforce, adding 6,000 employees during the quarter to reach a total headcount of 349,800.[1][8]

A primary engine behind Cognizant's impressive quarter is its accelerating momentum in securing large-scale client contracts. The company signed six large deals in the third quarter, defined as contracts with a total value of $100 million or greater.[1][9] This activity brought the year-to-date total to 16 such deals, fueling the 40% growth in large deal total contract value compared to the same period last year.[1][10] This surge in significant contracts is a testament to what CEO Ravi Kumar S described as clients' confidence in the company's ability to deliver value in a rapidly evolving technology landscape.[4] The company's trailing-twelve-month bookings increased 5% year-over-year to $27.5 billion, representing a healthy book-to-bill ratio of approximately 1.3x, which indicates a strong pipeline for future revenue.[1][6] This success in winning major deals is directly linked to the company’s strategic pivots and investments, particularly in high-growth areas that resonate with enterprise-level digital transformation needs.

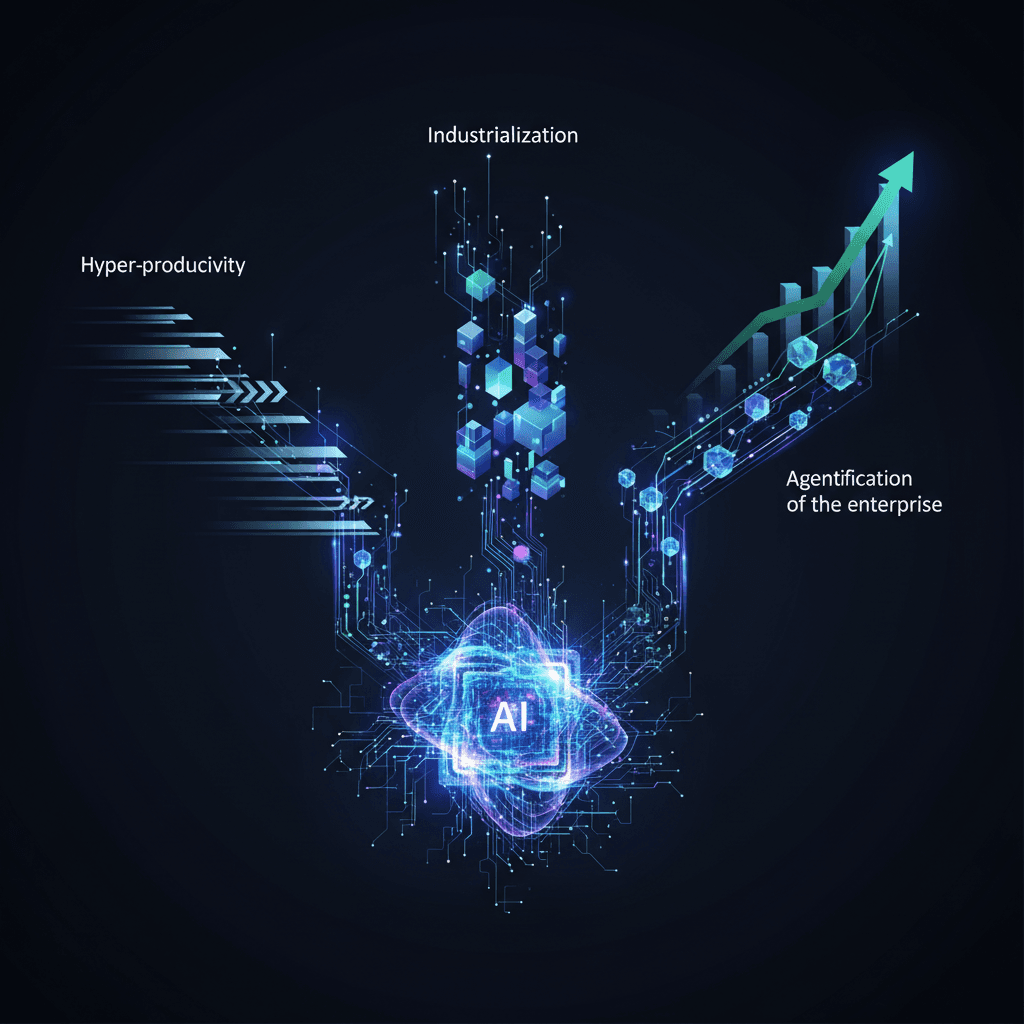

At the core of Cognizant's strategy and recent success is its deep investment in artificial intelligence, framed by what the company calls its "three-vector AI builder strategy."[1][12] This strategy is designed to capture the expanding market for AI-driven services and is seen by leadership as a key pillar for future growth.[13][10] The first vector focuses on enabling hyper-productivity for clients by applying AI to software development cycles, using platforms like its "Cognizant Flowsource" to generate code, improve quality, and accelerate project delivery.[14][15] The second vector involves industrializing AI, where the emphasis is on developing domain-specific, scalable AI solutions tailored to industries like healthcare, financial services, and retail.[13][15] The third, and potentially most transformative, vector is the "agentification" of the enterprise. This involves deploying autonomous AI agents to handle complex business processes, which Cognizant believes will unlock new pools of labor and expand its services from technology into the operational core of its clients' businesses.[16][13][14] The company is backing this strategy with significant capital, including a previously announced plan to invest $1 billion in generative AI over three years, and extensive training programs for its global workforce.[17][16]

In conclusion, Cognizant's strong third-quarter performance provides a clear indication that its strategic focus on large-scale transformation projects and artificial intelligence is yielding significant returns. The combination of beating revenue and earnings expectations, raising full-year guidance, and, most notably, achieving 40% growth in large deal value, points to a company gaining traction in a competitive IT services market.[1][8] The articulation of its three-vector AI strategy provides a clear roadmap for how it intends to not only enhance productivity but also create new, integrated service lines that embed AI deep within client operations. As enterprises worldwide continue to grapple with the complexities and opportunities of AI, Cognizant has positioned itself as a key partner in that evolution, suggesting that its current momentum is not just a quarterly success but a foundation for sustained growth in the AI-driven economy.

Sources

[2]

[8]

[10]

[11]

[13]

[15]

[16]