AI Subscriptions Outspend Netflix in South Korea, Signaling Utility Over Entertainment.

South Korea’s financial pivot proves utility is king, creating a global blueprint for the indispensable AI economy.

January 18, 2026

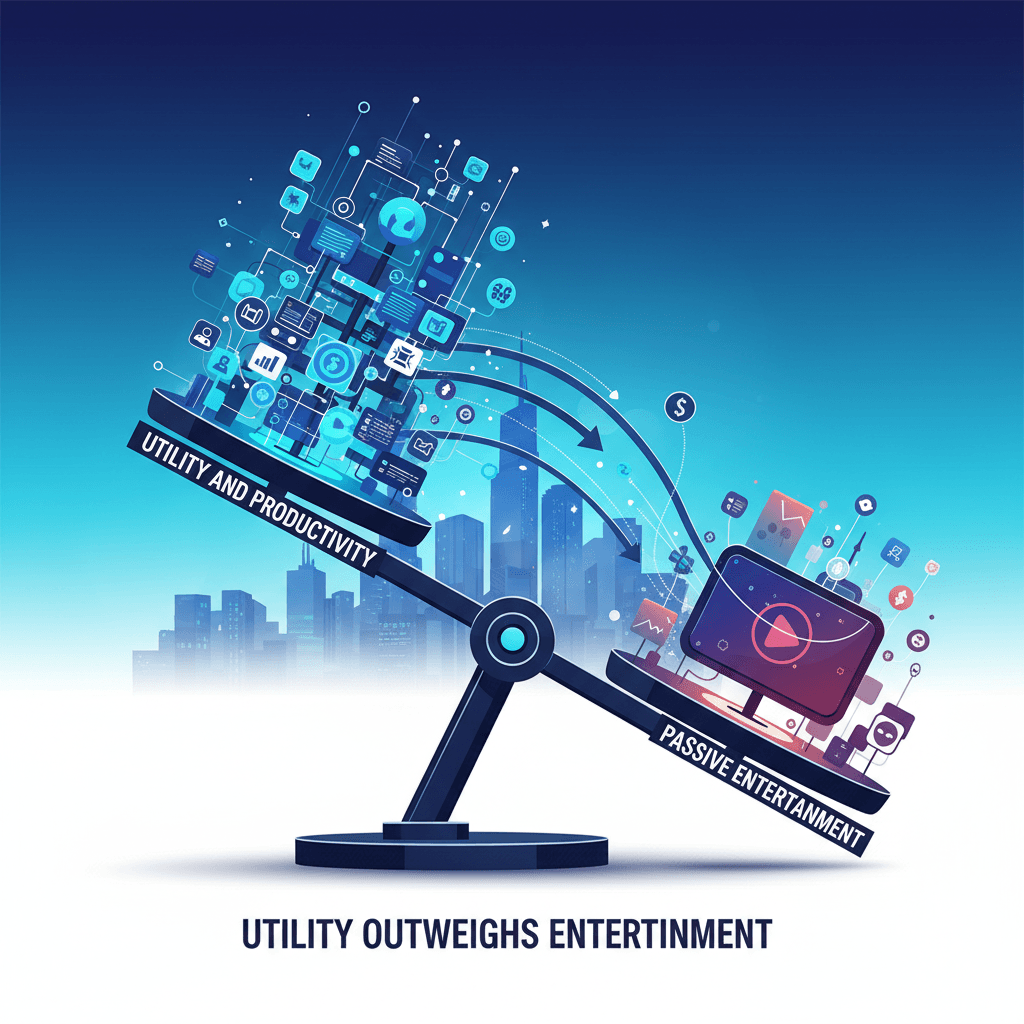

The South Korean consumer market has reached a critical inflection point in the global digital economy, demonstrating a decisive shift in spending priority as monthly expenditure on artificial intelligence subscriptions now surpasses that on the dominant streaming service, Netflix. This landmark change, which saw payments for a basket of major AI services—including the market leader, ChatGPT, along with Google Gemini—exceed the average monthly revenue generated by Netflix in the country, signals the beginning of the "utility subscription" era, where software that enhances productivity is valued above passive entertainment.

Data from the final quarter of last year showed an estimated 80.3 billion won (approximately $55-60 million) was spent on just seven major AI services in a month, outstripping Netflix’s monthly revenue, which had been tracking around 75 billion won (roughly $50-55 million). This financial pivot is not merely a statistical anomaly but a reflection of the nation's rapid and deep integration of generative AI into daily life. South Korea has distinguished itself globally, becoming the second-largest market for paid ChatGPT subscriptions, trailing only the United States, a feat made all the more notable by the country's comparatively small population[1][2][3].

The outsized role of generative AI in the South Korean economy is largely driven by the pursuit of professional and academic efficiency, coupled with an ultra-high-tech national infrastructure. The country boasts one of the world's most robust digital ecosystems, with smartphone usage exceeding 95 percent of the population and ubiquitous broadband, creating a fertile ground for the instantaneous adoption of new technology[4]. Unlike many markets where AI use remains a novelty, in South Korea, it has quickly become structural. Users spend an average of 367 minutes per month on the ChatGPT app alone, indicating a deep, almost daily integration into their routines for tasks beyond simple search and into areas like complex writing, planning, and analysis[5][6]. The number of South Koreans paying for AI services surged more than sevenfold in the past year, with users citing efficiency in information retrieval (87.9%), assistance with daily tasks (70.0%), and conversational interaction (69.5%) as the primary drivers[3][7].

The market dominance of foreign players, primarily OpenAI’s ChatGPT, is evident in the financial data. South Korea contributes a disproportionately high 5.4 percent of ChatGPT’s global revenue from a modest 1.5 percent of total downloads, demonstrating an unusually high propensity for paid subscriptions over free-tier usage[6]. However, the AI subscription ecosystem is diversifying. Local competitors and other global giants are actively vying for market share. Besides the domination by ChatGPT and Google's Gemini, other prominent services gaining traction include SK Telecom's AI assistant A., Wrtn Technologies' WRTN, and Anthropic's Claude, confirming that consumers are experimenting with and adopting multiple tools to fulfill different needs[8][9]. This proliferation of services and a willingness to subscribe to several platforms simultaneously—with some global studies indicating the average subscriber pays for four different AI tools—is what drives the overall expenditure past the streaming sector[10].

The implications of this shift extend far beyond South Korea’s borders, serving as a global blueprint for the future of the subscription economy. This market is a key indicator that AI has moved from a speculative technology to an indispensable utility, akin to the internet or mobile service. The willingness of a highly digital consumer base to prioritize a monthly fee for productivity tools over one for entertainment signals a profound change in the perceived value of digital services. Global research echoes this sentiment, with a majority of subscribers in other markets reporting that they now consider their AI subscription to be the most important digital service they have, even ahead of streaming[10]. This phenomenon is predicted to spur a "bundle boom," where consumers and businesses demand that AI tools be integrated and consolidated with other services, such as mobile contracts or even streaming packages, for simplified billing and management[11]. The pressure is mounting on global technology platforms to "crack the bundling code" and become the new gateway to the AI economy, suggesting a future where AI features become the premium layer on top of existing digital services[11].

Despite the enthusiasm, the surge is not without its challenges. Consumers have raised concerns about data privacy and the ethical transparency of the algorithms driving these tools, with nearly 70% of respondents in one survey saying that AI recommendation services should disclose the criteria behind their content-filtering, a clear demand for algorithmic accountability[3][7]. As AI subscription spending continues its vertical climb, propelled by government policies accelerating AI integration and improved model performance in the Korean language, the South Korean market acts as a vital petri dish[12][13]. It offers global tech companies invaluable data on the commercial viability, user behavior, and necessary guardrails for a world where generative AI is not just a tool for early adopters but a non-negotiable part of modern life. This national priority shift solidifies the revenue model for the global AI industry and demonstrates to the world that, for the digitally advanced consumer, utility is the new king of the recurring bill[14][15].