SoftBank Acquires DigitalBridge, Gaining Control of AI's Physical Backbone

SoftBank’s $4 billion acquisition of DigitalBridge vertically integrates the AI stack, securing global compute infrastructure.

December 30, 2025

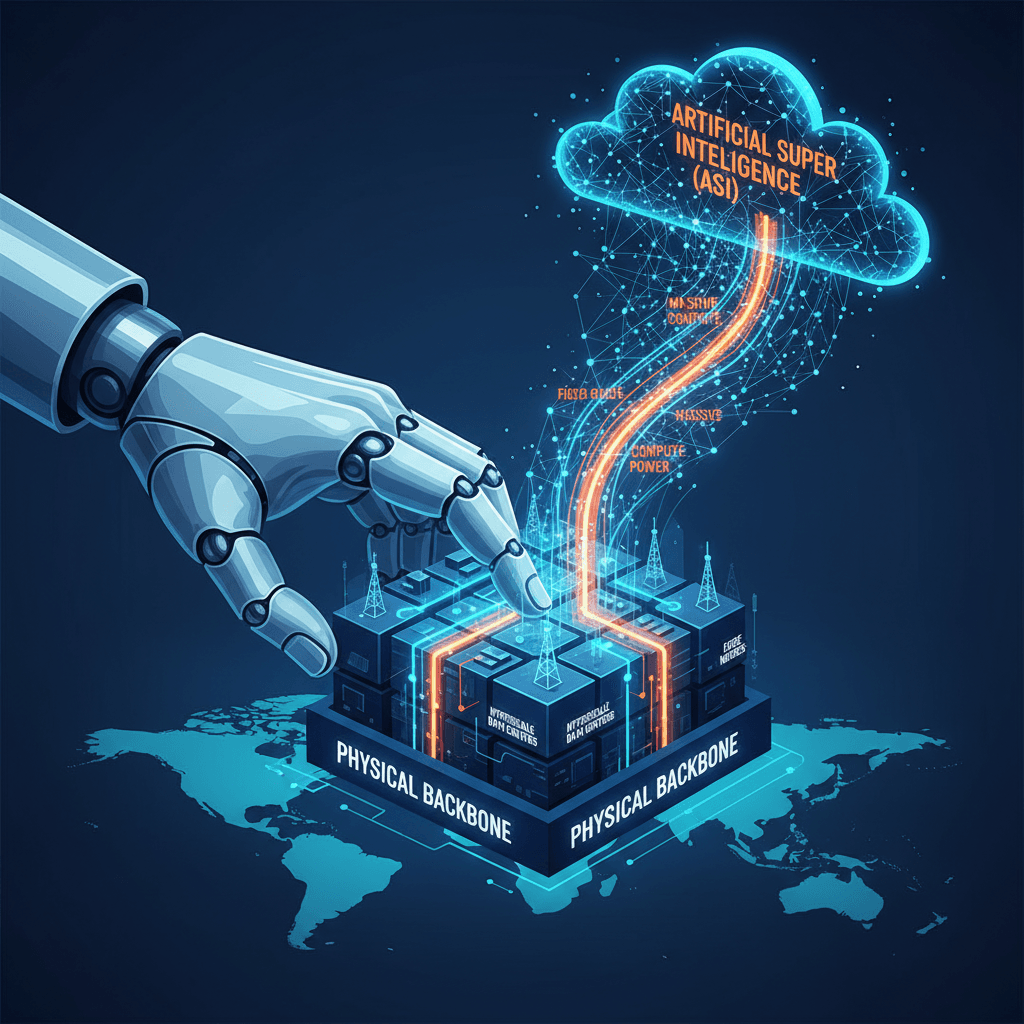

SoftBank Group's agreement to acquire DigitalBridge Group for approximately $4 billion marks a profound strategic pivot, solidifying the Japanese conglomerate's foundational commitment to the burgeoning artificial intelligence economy. The all-cash transaction, which sees SoftBank acquiring the digital infrastructure investment firm at a significant premium, is not merely a financial play but a calculated move to secure and scale the physical backbone necessary for next-generation AI systems globally. Founder and CEO Masayoshi Son has made it clear that the future of SoftBank is centered on Artificial Super Intelligence, and this acquisition provides the critical, large-scale infrastructure assets required to realize that vision.

The deal’s rationale is rooted in the unprecedented demand for computing power driven by the rapid development and deployment of generative AI models. Modern AI requires immense capacity for training and operation, necessitating a massive global expansion of purpose-built data centers, fiber networks, and related connectivity infrastructure. DigitalBridge, with approximately $108 billion in assets under management across a diverse portfolio that includes data centers, cell towers, fiber, and edge infrastructure, offers SoftBank immediate, deep exposure to this essential segment of the technology stack. The firm's portfolio includes major data center operators like Vantage Data Centers, DataBank, and Switch, which are directly involved in some of the industry's most significant AI-focused infrastructure projects. Vantage Data Centers, for instance, is a key builder in a massive AI campus initiative in Wisconsin and another large-scale facility in Texas, underscoring DigitalBridge's direct link to the escalating compute arms race.[1][2]

DigitalBridge’s extensive global footprint and expertise in managing complex digital assets provide SoftBank with a ready-made platform to execute its ambitious infrastructure goals. By gaining control of this investment manager, SoftBank effectively secures a direct, reliable channel to source, finance, and expand digital infrastructure projects worldwide, circumventing the need to build its own institutional expertise from scratch. This integration is crucial, as SoftBank is already a key partner in the multi-billion-dollar Stargate initiative, a massive computing and infrastructure project aimed at supporting advanced AI development alongside companies like OpenAI and Oracle. The ability to leverage DigitalBridge’s expertise, which spans the full spectrum of digital infrastructure from hyperscale data centers to edge computing, will be vital in ensuring that SoftBank can secure essential AI capacity at a global scale.[3][4][2][5]

The move signals an industry-wide recognition that control over physical infrastructure—the 'compute backbone'—is becoming the new competitive differentiator in the AI landscape, moving beyond just chip design and software models. SoftBank’s acquisition directly addresses the scarcity of the key components for AI development: compute, connectivity, and power. DigitalBridge’s involvement in fiber networks and edge infrastructure, which deploy smaller server clusters closer to end-users, is particularly strategic. This edge capacity is essential for delivering low-latency AI applications in real-time environments, ranging from autonomous vehicles to industrial robotics. Furthermore, the acquisition of DigitalBridge's credit division, which provides financing for data center construction, offers SoftBank a tool for accelerating the capital deployment needed to meet the escalating infrastructure demands.[1][6][7]

In the broader context of the AI industry, this acquisition has significant implications. It underscores a growing trend of vertical integration among technology giants, where companies are increasingly seeking to control every layer of the AI ecosystem, from the silicon (Arm Holdings, in which SoftBank has a majority stake) to the cloud platforms and, now, the underlying physical assets. Analysts suggest that the deal may pave the way for a wave of further consolidation in the digital infrastructure space as competitors recognize the need to make similar foundational bets to secure their position in the AI future. The transaction is expected to close in the latter half of next year, pending regulatory approvals. Upon completion, DigitalBridge will continue to operate as a standalone, separately managed platform, retaining its current leadership, which is intended to maintain the firm’s operational momentum and specialized focus on digital infrastructure investment.[1][8][2][9]