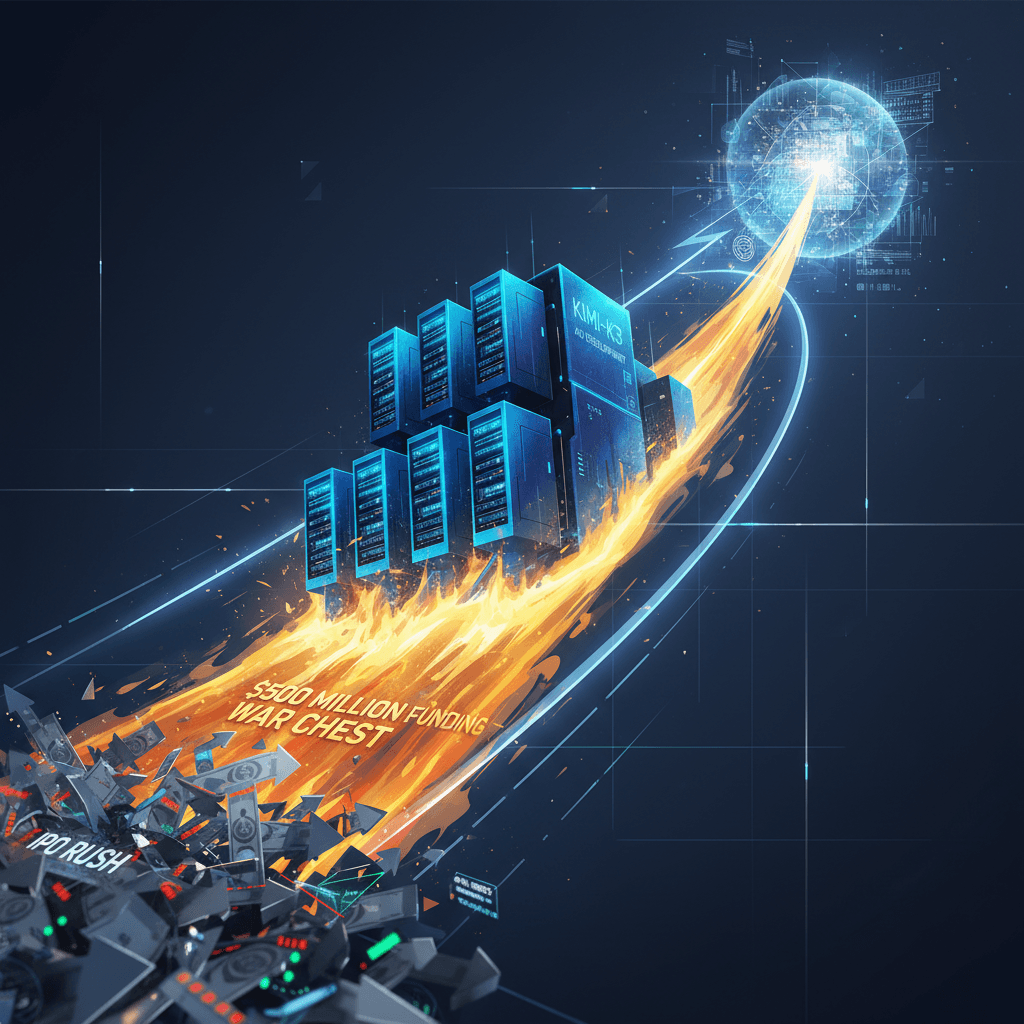

Moonshot AI Raises $500M, Fueling Massive Computational Race for AGI

Shunning the IPO path, the $4.3 billion firm commits its massive war chest to radical Kimi-K3 scaling and long-term AGI.

January 1, 2026

The Chinese artificial intelligence unicorn Moonshot AI has successfully closed a significant $500 million Series C funding round, catapulting its valuation to $4.3 billion and solidifying its position among the world's most highly capitalized AI startups.[1][2][3] The massive capital injection is earmarked for an aggressive expansion of the company's computing resources and the acceleration of its next-generation foundational model, Kimi-K3, marking a bold commitment to deep technological development in the fierce global AI race.[1][4] The financing round was led by IDG Capital, which contributed $150 million, and saw robust participation from existing strategic backers, including Chinese tech titans Alibaba and Tencent, alongside Meituan co-founder Wang Huiwen.[1][3][2] This substantial private backing has gifted the Kimi chatbot developer a strategic advantage, providing a financial war chest that allows it to prioritize long-term research and development for Artificial General Intelligence (AGI) over the immediate pressures of a public offering.

The newly secured capital positions Moonshot AI with cash reserves exceeding 10 billion RMB, which translates to approximately $1.4 billion, a sum comparable to the expected cash positions of its domestic rivals post-IPO.[3][5][6] This profound financial security has informed the company’s distinct capital market strategy.[7] In an internal letter, founder and CEO Yang Zhilin confirmed the firm is "in no rush for an IPO in the short term," asserting that the ample funds enable a more focused investment in long-term technological advancement.[1][2][7] This approach stands in stark contrast to the trajectory of fellow Chinese AI startups, often referred to as "AI Tigers," such as MiniMax and Zhipu AI, which are reportedly preparing for initial public offerings to secure the colossal funding required for model development.[2][6] By shunning the public market for now, Moonshot AI signals a commitment to a multi-year development cycle for AGI, leveraging the private market's enthusiasm for frontier AI to maintain a focus purely on engineering and research milestones.[6]

The primary directive for the new half-billion-dollar fund is a radical scaling of its underlying AI infrastructure, which is critical for training increasingly powerful large language models.[1][6] Specifically, the capital will be used to "aggressively expand GPU capacity," directly fueling the intensifying global arms race for high-end graphics cards, the indispensable component for modern AI training.[4][1] This investment directly supports the ambitious goals set for the next-generation Kimi-K3 model.[4] The company has mandated that Kimi-K3's pre-training performance must be brought up to par with the world's leading models, which will necessitate increasing its equivalent computational operations, or FLOPs, by at least an order of magnitude over its predecessor.[4] Beyond raw performance, the development strategy is focused on making K3 a "distinctive" model, integrating advanced training technologies and product experience to offer capabilities not available in rival models.[4] This strategic technical leap underscores the current industry trend where mere incremental improvements are no longer sufficient, and the pursuit of truly novel, agentic intelligence is the key to market differentiation and AGI progress.

Moonshot AI's decision to double down on deep R&D is predicated on the notable commercial traction of its existing model, Kimi K2.[6] The Kimi K2 Thinking model, a Mixture-of-Experts (MoE) architecture with one trillion total parameters, has demonstrated a particular aptitude for agentic tasks, enabling it to act beyond simple question-answering by performing step-by-step reasoning and utilizing third-party tools.[8][9][6] This focus on complex problem-solving has translated directly into revenue growth.[4] Driven by the K2 Thinking model, Moonshot AI has reportedly seen a fourfold increase in its overseas Application Programming Interface (API) revenue.[4][6] Furthermore, its global paid user base has experienced remarkable month-on-month growth, surging by 170%.[4][2] This dual success—combining frontier technical capability with a burgeoning commercial pipeline—has made the startup a standout in a highly competitive market and attracted top-tier private investment, validating its technology-first development path.[6]

The successful Series C round is more than just a financial transaction; it represents a significant structural divergence in the global AI industry's fundraising landscape.[2] By securing a valuation of $4.3 billion and accumulating a substantial, privately-backed war chest, Moonshot AI has purchased the time and resources needed to chase the computationally expensive and technically challenging goal of AGI without the quarterly scrutiny of public shareholders.[1][7][6] The company is now positioned to join the highest echelon of foundational model developers worldwide, using the massive capital to buy the compute and talent necessary to challenge both domestic and international giants.[1] The goal to achieve an "order-of-magnitude increase in revenue scale" alongside the launch of the K3 model, focusing on the high-value productivity of AI Agents, demonstrates a clear, capital-intensive strategy to become a dominant force in the global AI ecosystem, cementing the firm's role as a major pillar in the growing depth of China's AI industry.[4][10]

Sources

[1]

[2]

[3]

[4]

[5]

[7]

[8]

[9]

[10]