India's AI Surge Forces $7.7 Billion Liquid Cooling Revolution in Data Centers

AI and Hyperscale Drive India’s Data Center Cooling Market to Triple by 2030, Accelerating the Shift to Liquid Solutions

December 30, 2025

The rapid expansion of India’s data centre landscape, fueled by a confluence of artificial intelligence, cloud adoption, and a national push for data localisation, is set to create a massive ancillary market for cooling systems, with projections indicating a nearly three-fold growth by 2030. This surge is documented in industry reports and reinforced by government initiatives, which highlight the critical link between compute capacity and the energy-intensive cooling infrastructure required to sustain it. The total installed data centre capacity in the country, which was estimated to be around 1.1 GW in 2024, is poised to reach an estimated 3 GW by 2030, a monumental expansion that directly dictates the growth trajectory of the cooling market.[1][2]

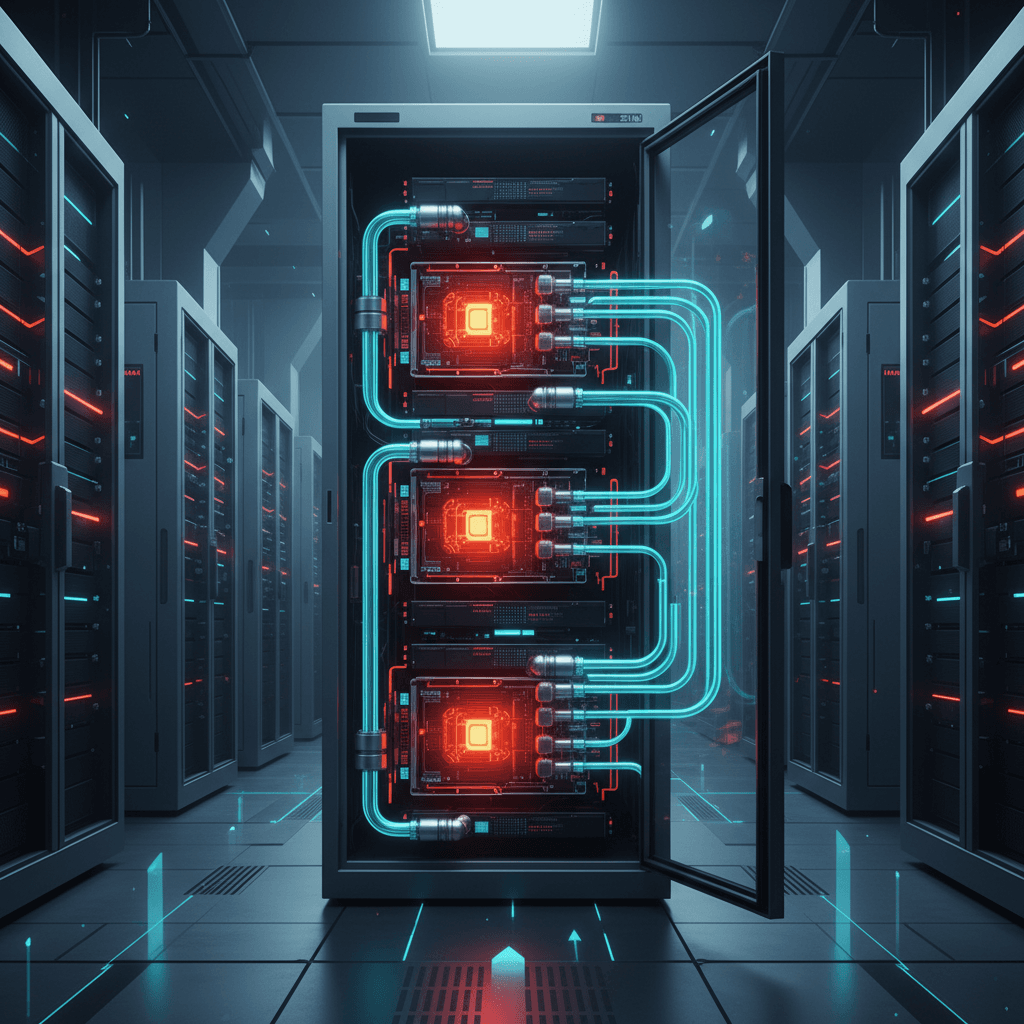

Industry analysis forecasts that the India data centre cooling market, which was valued at approximately USD 2.38 billion in 2025, is expected to surge to USD 7.68 billion by 2030, reflecting a compound annual growth rate (CAGR) of 26.42%.[3] This enormous growth is fundamentally driven by the shift towards high-performance computing (HPC) and AI workloads, which place unprecedented thermal demands on data centre facilities. Traditional air-based cooling systems, while still dominant in existing infrastructure, are being rapidly challenged by the increasing rack power densities, which are now crossing the 15 kW threshold and compelling operators to evaluate liquid-based cooling solutions.[3] The government’s proactive stance, including the allocation of capital for developing data centre parks and offering various fiscal incentives, further accelerates this trend, mandating the adoption of energy-efficient technologies to reduce the sector’s overall carbon footprint.[4]

The proliferation of Artificial Intelligence is unequivocally the single most influential factor shaping the future of India’s data centre cooling requirements. Generative AI, machine learning, and complex data analytics require clusters of powerful Graphics Processing Units (GPUs) that generate significantly more heat than traditional CPUs. Hyperscale operators—major players like Microsoft, Google, and Amazon Web Services—are leading this charge, and they are standardizing their architectures to be 'liquid-ready' in order to support racks exceeding 40 kW of power density.[3] This adoption includes advanced techniques such as direct-to-chip cooling, which transfers heat directly from the server component using a non-conductive fluid, dramatically improving power usage effectiveness (PUE) ratios.[3] The transition reflects a necessary evolution, as liquid cooling solutions—which are projected to exhibit the fastest growth at a 27.7% CAGR—are demonstrably more energy-efficient for high-density applications than incremental upgrades to legacy air-cooling methods.[3]

The scale of India’s data expansion, largely centered on the digital economy projected to reach USD 1 trillion by 2025, necessitates a proportional expansion of physical infrastructure. The demand for new, AI-ready data centres is estimated to require an additional 45-50 million square feet of real estate by 2030.[5] This figure underscores the immense civil and mechanical engineering challenge facing the industry. Core markets like Mumbai Metropolitan Region (MMR), Chennai, and Bengaluru remain the primary hotspots, contributing a significant majority of the current data centre stock.[4][6] However, government-backed incentives are encouraging the development of new hyperscale corridors in areas like Delhi NCR, and the need for low-latency processing for real-time AI applications is also pushing the demand for edge data centres in Tier 2 and Tier 3 cities such as Jaipur, Kochi, and Lucknow.[7][2][6] The geographically distributed nature of this growth means cooling solutions must be robust and resilient enough to operate effectively amidst varying regional environmental conditions, including high ambient temperatures and grid instability.

Beyond the technological imperative, the regulatory and environmental landscape in India is heavily influencing the cooling market's direction. The government's push for data sovereignty and localisation mandates that data be stored and processed within national borders, solidifying the need for domestic data centre capacity.[3][1] Concurrently, there is a growing national emphasis on sustainability, with regulatory bodies implementing stringent energy efficiency regulations aimed at reducing the carbon footprint of data centres, which are major consumers of grid power.[8][9] This focus on green data centre certifications and lower PUE ratios is driving investment not just in efficient cooling *equipment*—such as chilling units, cooling towers, and liquid cooling systems—but also in *services* like consulting, installation, and maintenance.[3][8][10]

The shift in cooling technology has significant implications for both water management and grid power infrastructure. The initial image of the water crisis serves as a stark reminder that while advanced cooling is essential, traditional evaporative cooling systems, which are highly effective, can be extremely water-intensive.[7] The move toward next-generation liquid cooling, including immersion cooling, is often positioned as an environmentally superior option, as it is non-evaporative and can drastically reduce water consumption compared to older chiller-based systems. Simultaneously, the energy demands are considerable: the projected capacity addition of nearly 4.8 GW by 2030 requires robust and continuous power supply, making energy efficiency in cooling—the single largest energy consumer in a data centre—a strategic priority for national energy security.[1][9] Companies are thus aligning their development plans with green certifications and deploying innovative technologies, such as the 'Integrated Flat Thermosyphon Heat Sink (IFTHS)' developed by Indian researchers, to enhance chip-level thermal management and reduce the load on room-based air conditioning.[5]

In conclusion, India’s data centre surge is not merely a matter of adding storage capacity, but a strategic infrastructural transformation driven by the requirements of the global AI industry. The market for data centre cooling is experiencing a dramatic metamorphosis, set to triple in size as operators transition from conventional air-cooling to advanced, liquid-ready solutions capable of handling the extreme thermal loads of modern AI computing. This transition is being mandated by technological necessity, supported by government policy, and shaped by a dual focus on delivering hyper-scale compute power while adhering to national sustainability and energy efficiency goals. The confluence of massive investment, technological innovation, and a supportive regulatory environment positions India’s data centre cooling market as one of the fastest-growing and most critical segments of the nation's digital future.[3][1][2]