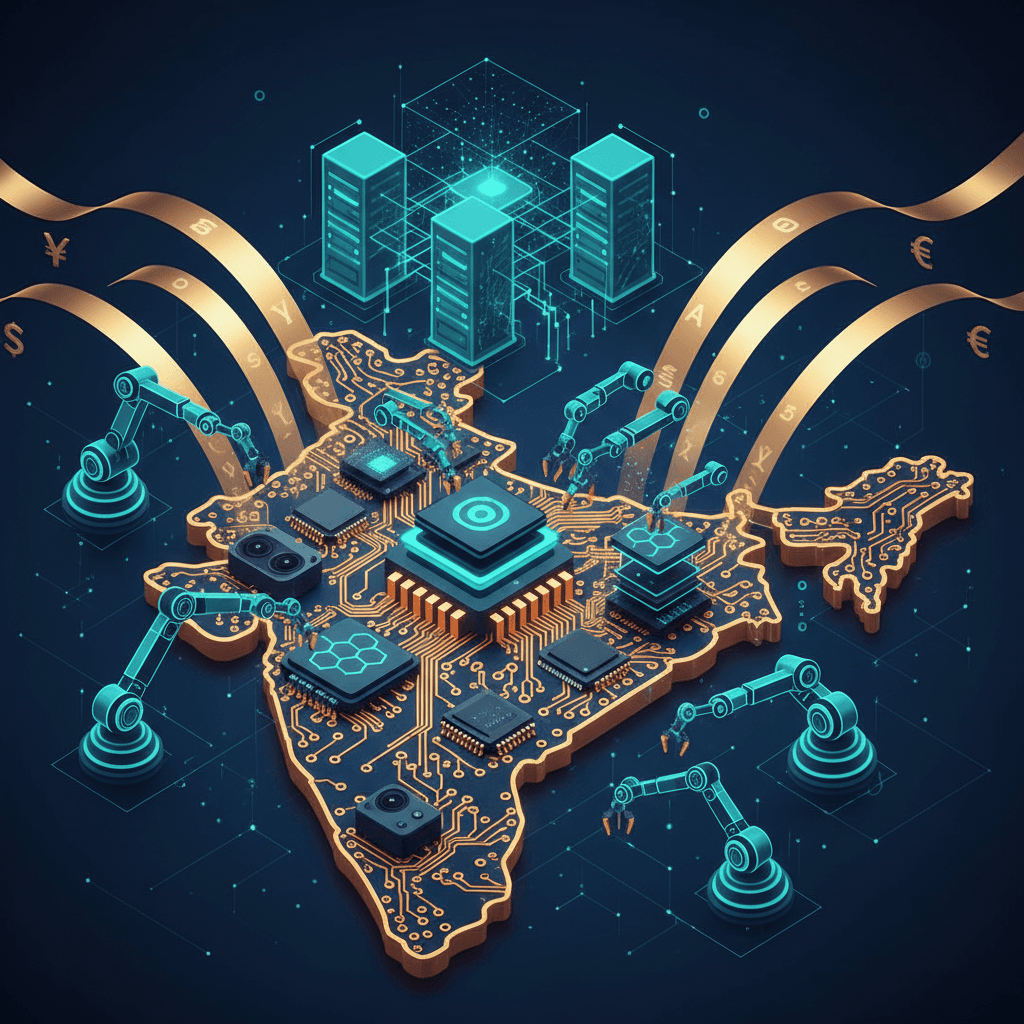

India Commits ₹41,863 Crore to Build AI Hardware Foundation and Self-Reliance.

Massive ₹41,863 crore investment deepens component manufacturing, laying the essential hardware foundation for India's AI future.

January 2, 2026

The Ministry of Electronics and Information Technology (MeitY) has announced a significant acceleration in India’s quest for electronics self-reliance, approving 22 new proposals under the third tranche of the Electronics Components Manufacturing Scheme (ECMS), committing a massive projected investment of ₹41,863 crore. This latest wave of approvals is expected to catalyze a cumulative production value of ₹2,58,152 crore and create 33,791 direct jobs, representing a major leap forward in the nation’s 'Make in India' and 'Aatmanirbhar Bharat' initiatives. This tranche alone accounts for a substantial majority of the total investment intention under the scheme to date, underscoring a growing confidence among both domestic and global investors in India's emerging electronics ecosystem.[1][2][3][4]

The Electronics Components Manufacturing Scheme is a cornerstone of the government's strategy to move beyond mere assembly and establish a deep, integrated domestic supply chain for high-value electronics. The scheme, which was notified with a total outlay of ₹22,919 crore for six years, aims to develop a robust component ecosystem by attracting large investments and integrating Indian companies with Global Value Chains (GVCs).[3][5][6][7] The focus is on bridging critical gaps in the supply chain that currently necessitate heavy import dependence, especially for key parts that are the building blocks of finished electronic products.[1][2] The latest approvals bring the total number of projects cleared under the ECMS to 46, which collectively represent an investment intention of ₹54,557 crore.[3][4] The robust response, with total investment proposals crossing ₹1.15 lakh crore for the overall scheme, significantly exceeds the initial target, signaling a paradigm shift in India's manufacturing landscape.[3][8]

The newly approved projects span a diverse and strategically critical range of products across 11 target segments that have cross-sectoral applications in mobile manufacturing, telecom, consumer electronics, strategic electronics, automotive, and IT hardware.[1][2][9] This diversification is vital to building an ecosystem that is resilient and capable of supporting multiple high-growth industries. The approved segments include five bare components, such as Printed Circuit Boards (PCBs), capacitors, connectors, enclosures, and high-demand Lithium-ion (Li-ion) cells.[1][2][4] Additionally, the approvals cover three key sub-assemblies: camera modules, display modules, and optical transceivers, which are essential for final product integration.[2][9] Finally, three supply chain products—aluminium extrusion, anode material for batteries, and laminate for PCBs—have also been approved, addressing the very upstream raw material and intermediate goods segments.[1][9] This comprehensive approach, from bare components to sub-assemblies and supply chain materials, demonstrates a concerted effort to deepen domestic value addition, with the goal of increasing it from the current 15-20% to as much as 35-40% over the next five years.[8]

The strategic significance of this investment, particularly for the burgeoning Artificial Intelligence (AI) industry, cannot be overstated. The foundational hardware for AI—high-performance computing, data centers, smart devices, and edge computing—is entirely reliant on advanced electronic components. The emphasis on manufacturing complex items like multilayer and high-density interconnect (HDI) PCBs, as part of the PCB push, is a critical upstream development that directly feeds into the creation of advanced computing hardware.[10][11] Furthermore, the approved manufacturing of Li-ion cells and anode materials is crucial for the power backbone of AI-enabled systems, from autonomous vehicles and smart robots to large-scale data center infrastructure, which is a key component for AI model training and deployment. The camera modules and display modules are also the sensory and output systems for a vast range of AI-driven consumer and industrial electronics. By localizing the production of these high-tech components, India is not only reducing import risks but also laying the groundwork for developing indigenous AI hardware design and manufacturing capabilities. The move signifies a shift for the electronics industry from mere device assembly to a focus on component production, which is a necessary precursor for becoming a global leader in AI-era technology.[10][7]

The geography of the investment also reflects a balanced and national vision for industrial expansion, with projects spread across eight states: Andhra Pradesh, Haryana, Karnataka, Madhya Pradesh, Maharashtra, Tamil Nadu, Uttar Pradesh, and Rajasthan.[1][2][9] This geographical dispersion is designed to foster industrial growth and high-skill job creation across the country, moving beyond concentrated industrial clusters. The list of approved companies includes major global and domestic players like Dixon Technologies, Samsung Display Noida, Foxconn (Yuzhan Technology India), and Hindalco Industries, alongside others such as Vital Electronics, Motherson, Amara Raja-ATL, and Tata Electronics.[1][2][4] The presence of such diverse and large-scale enterprises committing substantial capital—exemplified by Vital Electronics setting up a multi-layer PCB facility in Maharashtra, and Motherson's major project in Tamil Nadu—injects both capital and technological know-how into the domestic component ecosystem.[4] The scheme’s incentive structure, which combines turnover-linked, capital expenditure-linked, and employment-linked incentives, is designed to encourage not just production volume but also high-value-added manufacturing and significant job creation.[6] The focus on achieving global quality standards, such as Six Sigma, further indicates the government's intent to position India not just as a manufacturing hub for domestic consumption, but as a reliable and competitive player in the global electronics value chain.[12][13] In essence, the ECMS approvals mark a turning point where India is actively building the physical infrastructure of the digital age, which will serve as the essential, high-tech foundation for its aspirations to become a global AI powerhouse.[13][11]