GrowthPal Raises $2.6M to Bring AI Reasoning into M&A Decision-Making

Funding accelerates the AI M&A Copilot, moving deal-making from fragmented research to intelligent, proactive growth sourcing.

January 15, 2026

The digital investment banking platform, GrowthPal, has secured $2.6 million in a strategic funding round, earmarking the capital for the significant expansion and enhancement of its AI-driven M&A Copilot. The investment, led by Ideaspring Capital with participation from a global consortium of angel investors, arrives as corporate development teams worldwide accelerate their adoption of programmatic, data-driven approaches to inorganic growth. This funding will be used to deepen the platform’s product capabilities, specifically focusing on advanced AI-driven reasoning, and to fuel its geographical expansion across the United States and other key international markets.[1][2][3]

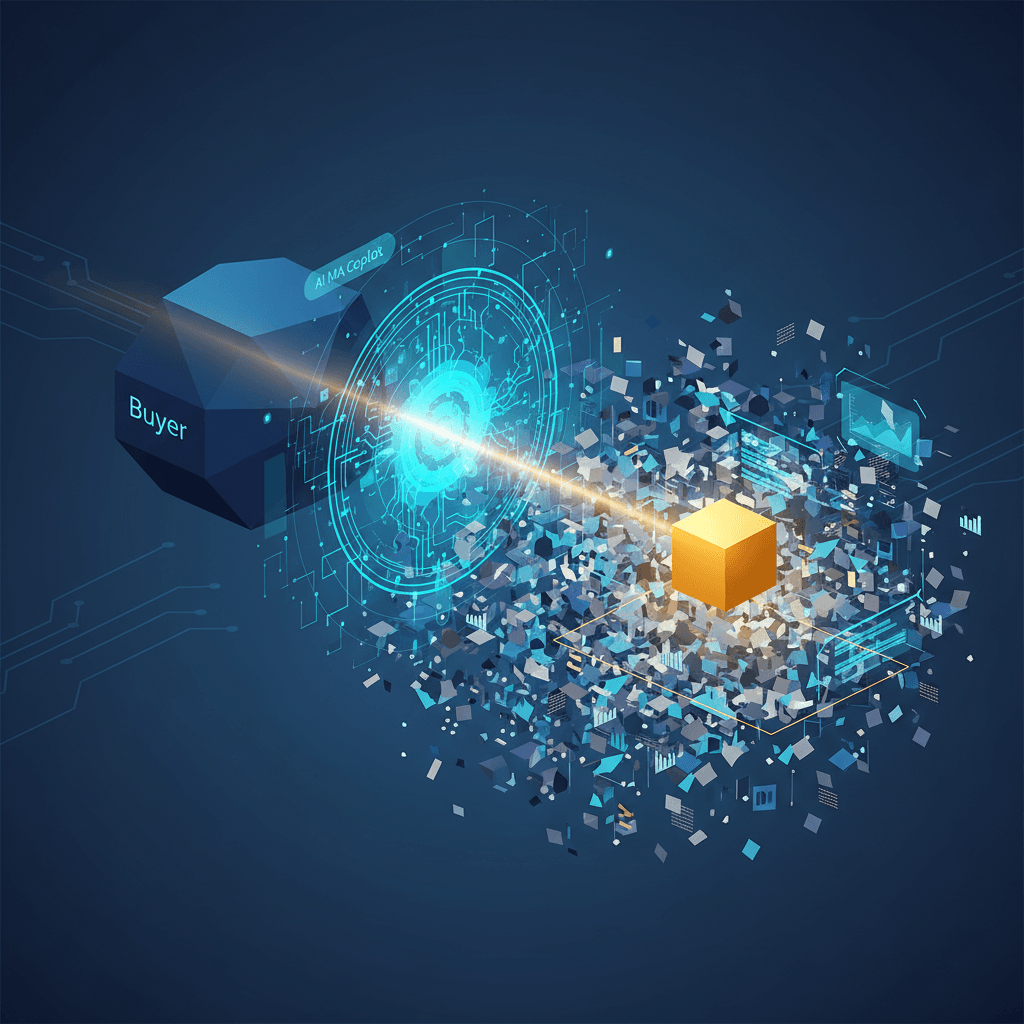

The influx of capital highlights a major shift in the mergers and acquisitions industry, which has historically been reliant on relationship-driven networks and fragmented manual research.[3][4] GrowthPal’s core innovation lies in applying artificial intelligence to solve the most time- and resource-intensive problem in M&A: sourcing qualified, high-fit targets, particularly within the mid-market space, which includes deals typically under $70 million and is often underserved by traditional investment banks.[1][2][5] The platform's AI M&A Copilot works by first converting a buyer's strategic objective—such as acquiring a specific technological capability or entering a new geography—into a structured acquisition thesis.[1][4] Its proprietary AI agents then scan a vast, enriched database of over four million technology companies, analyzing dynamic signals that include public filings, web activity, hiring patterns, and funding history to generate a precision-fit shortlist of high-intent, often off-market targets.[1][5][4] This contrasts sharply with legacy aggregation platforms that primarily offer broad, generic data lists, positioning GrowthPal as a system that provides reasoning and conviction on which companies truly align with a buyer's strategic goals.[3][4]

The planned product development enhancements are aimed at extending the AI Copilot’s intelligence deeper into the M&A transaction lifecycle, moving beyond its already robust deal-sourcing function.[1][2][4] Future capabilities are slated to include support for valuation reasoning, deal structuring, and comprehensive preparation for negotiation.[1][2] The company's long-term vision is to establish the Copilot as a core system of intelligence for end-to-end M&A decision-making, providing corporate development teams and private equity firms with greater clarity and confidence from discovery through to execution.[1][3][6] This expansion into late-stage deal support reflects the intensifying pressure M&A teams face to execute transactions with leaner resources and compressed timelines.[1][3] The technological sophistication is designed to transform M&A from a slow, reactive process into a continuously intelligent and proactive growth lever for companies seeking inorganic expansion.[7][6]

GrowthPal’s traction underscores the growing market validation for AI in corporate deal-making. The company has already reported supporting over 42 completed M&A transactions and facilitating more than 210 Letter of Intent (LOI)-stage engagements across North America, Europe, Asia, and Latin America.[1][2] One reported client leveraged the platform to execute seven acquisitions in an eighteen-month period, demonstrating the platform’s capacity to accelerate programmatic inorganic growth.[1] These metrics illustrate the efficiency gains achieved by focusing buyers only on high-fit targets, reducing the weeks traditionally spent on fruitless research, filtering, and outreach.[8][3] The success of this data-driven model, which operates across the technology, business services, and software sectors, solidifies the move toward a systematic approach to M&A that is quickly supplanting the reliance on human-intensive advisory models.[5][7]

The broader context of this funding round is the accelerating trend of artificial intelligence-driven transformation in the global M&A automation tools market, which is projected to grow into an $8.15 billion opportunity by 2033.[8] The adoption of AI in deal-making is not just a technology upgrade but a fundamental change in strategy, as companies recognize that the ability to reason across complex data signals and context is rapidly becoming a competitive advantage.[4] With a reported anticipation that more than half of global M&A teams will adopt AI tools by as early as 2027, the demand for platforms that provide decision-making support, rather than mere data aggregation, is poised to soar.[9] GrowthPal's strategic infusion of capital and product roadmap expansion positions it at the forefront of this market evolution, aiming to deliver the next generation of digital investment banking for the mid-market and high-growth enterprise sectors. The ultimate implication is the democratization of sophisticated deal-making, making high-quality, targeted acquisitions accessible and executable at an unprecedented speed and scale for corporate strategists globally.[1][5][6]