Grab Acquires Infermove, Deploying AI Robotics to Transform Southeast Asian Delivery.

The Southeast Asian giant pivots from human labor to AI automation to control costs and revolutionize last-mile delivery.

January 7, 2026

The rising tide of operational expenditure, particularly surging labor costs and the relentless squeeze on delivery margins, has driven the Southeast Asian super-app giant Grab to execute a pivotal strategy shift, bringing sophisticated robotics and artificial intelligence capabilities in-house. This comprehensive move, anchored by the acquisition of the Chinese AI robotics startup Infermove, signals a definitive turning point for the region’s logistics sector, positioning AI-driven automation as a core operational tool rather than a speculative pilot program. For a platform that facilitates millions of transactions across its massive ecosystem in over 800 cities and eight countries, even minute efficiency gains can yield an outsized and critical impact on its path to sustainable profitability.[1][2][3]

The decision to acquire Infermove is a direct response to intensifying financial pressures within the high-volume, low-margin delivery business. Grab, which commands a dominant market position, holding an estimated 50% to 72% of the delivery market share in Southeast Asia, faces structural headwinds that threaten to erode profitability.[4][2][5] Labor costs in ASEAN countries have been steadily climbing, with growth fueled by the rising cost of living and the need to retain skilled personnel, directly impacting the economics of platform operators who rely on a massive gig workforce.[6] Delivery efficiency, labor availability, and cost control have emerged as persistent, significant challenges.[1] By integrating robotics, Grab is not merely experimenting but is positioning automation as a long-term solution to stabilize operations and reduce dependence on a fluctuating human labor supply while simultaneously enhancing service quality and consistency.[1][7] The immediate focus for this technology is the first-mile and last-mile logistics—the most expensive and labor-intensive segments of the delivery chain, where costs are particularly high in dense urban environments.[1][8]

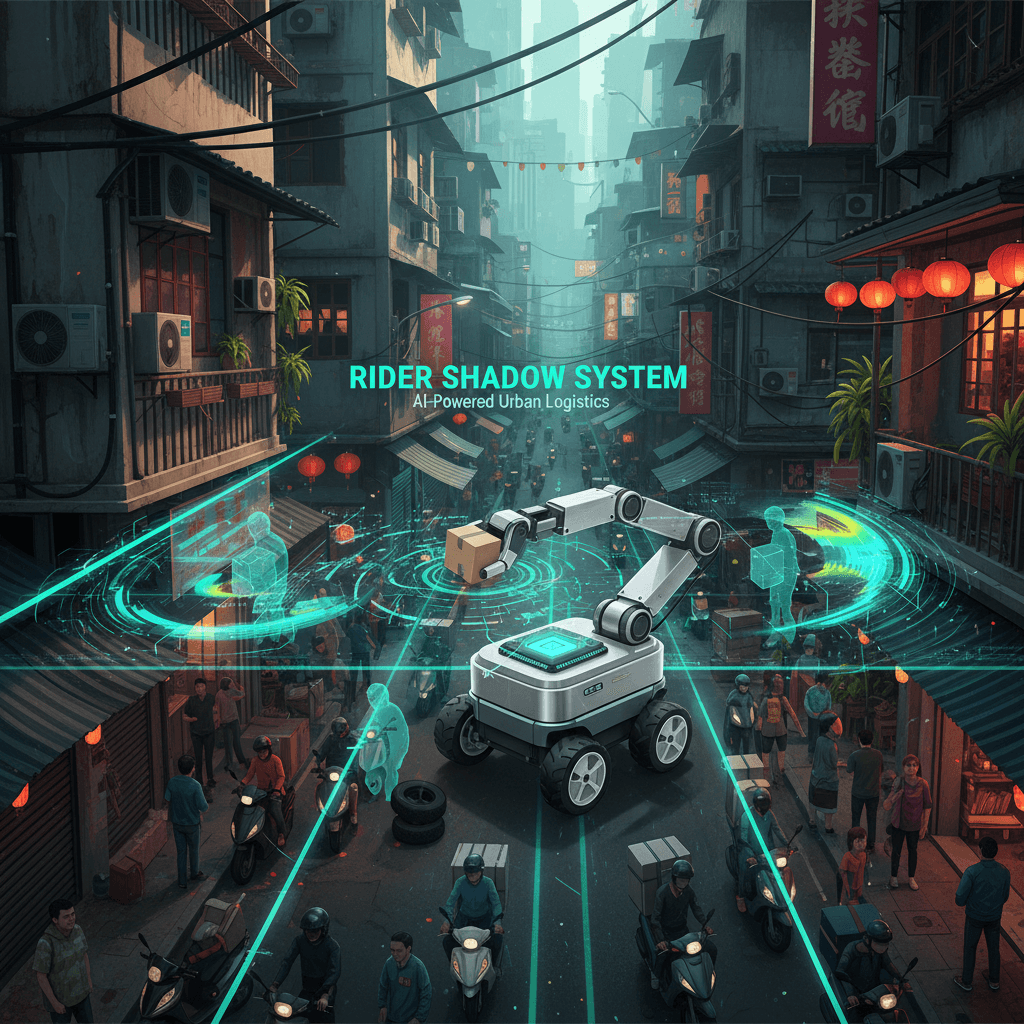

The value proposition of Infermove lies in its specialized approach to navigating the inherently complex and unstructured urban environments characteristic of Southeast Asian cities. Unlike controlled warehouse settings, last-mile delivery requires autonomous systems capable of handling sidewalks, unpredictable human and vehicle behavior, and various obstacles.[1] Infermove, founded in 2021 by former Level 4 autonomous driving program leader Aaron Lu, developed the Carri series of mobile manipulation robots, which include sidewalk delivery robots equipped with upper-limb capabilities.[9][10][8][11] The core technological differentiator is the company’s proprietary “Rider Shadow System.” This AI system tackles the industry-wide challenge of data acquisition by crowdsourcing real-world mobility data from non-motorized vehicles, such as delivery riders’ electric scooters and wheelchairs already operating on the platform.[9][10][12][13] This wealth of real-world data, combined with advanced AI techniques like imitation learning and reinforcement learning, trains the robots to exhibit human-like operational capabilities, enabling adaptation to intricate, real-world delivery scenarios.[10][13][7] This approach bypasses the reliance on costly, slow data collection or limited simulations, marking a critical step forward in the embodied intelligence sector.[12]

Infermove’s proven commercial traction further validates the strategic acquisition. The startup’s revenue experienced a surge, projecting a significant increase, indicating that the demand for delivery robotics is already moving beyond initial pilots into early-scale adoption within the competitive logistics market.[9][7][3] Before the acquisition, the company had established partnerships and deployments with major delivery platforms in China, including Meituan and Ele.me, and had launched pilot projects in key Grab markets like Singapore.[9][10] By bringing this technology development in-house, Grab gains the ability to rapidly iterate, customize the AI to the diverse and specific regulatory and infrastructural landscapes of its various markets, and ensure the technology seamlessly integrates with its established logistics network.[1] This shift positions Grab to leverage its own massive scale—represented by its 47.7 million monthly transacting users—to accelerate the training and deployment of its robotic fleet.[2]

The implications of this robotics strategy extend far beyond Grab’s immediate balance sheet, serving as a critical indicator for the future trajectory of the AI and logistics industries across Southeast Asia. The global last-mile delivery robotics market is projected by industry analysts to exceed a value of $20 billion by 2027, underscoring the massive market opportunity.[9][3][14] This acquisition is a high-profile example of a growing global trend where large consumer platforms view AI and robotics as a competitive differentiator to manage the duality of cost reduction and service expansion.[9][7] For the technology sector, the move validates the 'embodied intelligence' paradigm—developing AI that can learn and operate physically in complex real-world settings. For the region's vast gig economy workforce, the introduction of automated delivery systems is expected to first focus on complementing human couriers by handling repetitive, high-friction tasks, rather than an immediate, direct replacement.[1][8] However, the successful integration and scaling of autonomous delivery will inevitably reshape labor dynamics, requiring a broader societal and governmental response to the evolving nature of gig work in the region. Ultimately, Grab’s strategic in-housing of AI robotics is a crucial step in the evolution of regional commerce, signaling the quiet but profound integration of autonomous technology into the everyday delivery infrastructure of Southeast Asia.[1]

Sources

[4]

[5]

[6]

[8]

[10]

[11]

[12]

[13]

[14]